The European Central Bank is raising interest rates by two quarters and nonetheless expects inflation to remain elevated for some time. The Euro and interest rates are rising and some fluctuations on the price boards follow. In the end, the AEX (+1.5%) closed significantly higher.

Market commentator Arend Jan Kamp followed the entire press conference and shared all the news on live blog and upon it Twitter account. In addition to the 0.5% interest rate hike, Christine Lagarde also has a new high a tool Feet: TPI. This means a transfer protection instrument and is intended to limit the spread of interest rates between Germany and Italy. “New tool expands subsidy programs with inflation as a pretext,” Belgian economist Geert Noels wrote on Twitter.

Lagarde delves into VAT FT wonders why she said a few years ago that EU interest rate differentials aren’t what they are #ECBIt was and now it is

– Arend Jan Kamp (@ArendJanKamp) 21 July 2022

ASMI secures a record amount of orders

We’ll almost forget that we’re in the middle of earnings season and that the IEX was running at full capacity today. This morning, tech stock analyst Paul Weeteling was the first to go with analysis ASMI (+14%) who released numbers last night and was the biggest climber at Damrak today.

ASMI: The order can’t be stopped https://t.co/KTCVbUX1F2 # ASMI # AX #investment #Stores

– Paul Weeteling 21 July 2022

exactly like ASML (+5.2%) However, the delivery of orders is hampered by a shortage in the supply chain. Other similarities between the number reports of the two chip machine manufacturers also indicate high end chip machine market

With a quarterly turnover of €560 million (+36%), the company has reached the top of the latest forecast issued. Margins were lower due to the rapid rise in both parts and personnel costs. A less favorable sales mix would also reduce margins somewhat, according to ASMI. At the bottom of the line, a quarterly profit of €3.28 per share (+48%).

Another Bessie story

Was there this morning too Next to (+1.5%) who opened the books, but those numbers painted a less rosy picture. Weeteling quickly notes that “developing order taking in Besi is very different from that in ASML and ASMI, and it’s kind of challenging.”

“There are also some positives, but the poor outlook means that the presentation of these numbers is much less robust than we expected.” The big question is whether this is a short moment of weakness, or whether it will last longer. You can read all about it in the enlarger PC analysis.

Bessie: That’s a bit of a swallow https://t.co/FIiJZHuxFJ #Besi # AX #investment #Stores

– Paul Weeteling 21 July 2022

Tesla is on its way to score

Analyst Paul Whitling has been busy because Tesla (+7.3%) they still provide “excellent numbers”, despite the news that the automaker has achieved 75% of its position in Bitcoin (-4.6%) of the hand. Tesla exchanged cryptocurrency for $936 million. The reason will be the Chinese shutdown, the consequences of which are difficult to estimate and therefore the risks have been reduced where possible.

“The most positive point from the numbers report is that factories in Shanghai and Fremont finished June with record production and that Berlin and Austin are slowly gaining momentum. Tesla analysis.

Tesla: On the way to scoring https://t.co/mNdZWTw9GW # Tesla #investment #Stores

– Paul Weeteling 21 July 2022

question round

Tomorrow, analyst Nils Quartz and market commentator Arend Jan Kamp will run behind the microphone to record a brand new episode of the IEX InvestorsPodcast. As usual, you can leave your questions in the comments below.

The IEX InvestorsPodcast is aimed at advanced investors. If that’s too much for you, our new podcast called InvestorsBootcamp might be more suitable for you. In collaboration with Niels Koerts, I am making an accessible listening offering that helps people on their way to invest with confidence. Below you’ll find the first episode in which Economist and Entrepreneur Veronique Estée was a guest. And yes, this was part of the rude self-promotion.

Interests

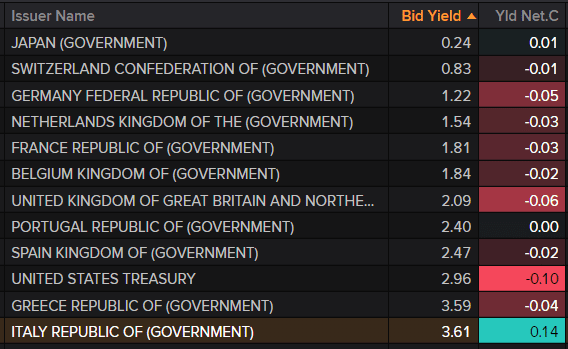

Market interest rates are dropping in most countries. In the Netherlands, the ten-year interest rate drops by three basis points to 1.54%. The only gainer is Italy, which rose by at least 14 basis points. This is partly due to the resignation of Mario Draghi, who has been Italy’s prime minister since February last year. He has been a symbol of stability, so his resignation brings with it uncertainty, which has driven up interest rates there.

wide market

- The AEX (+1.5%) outperformed the French CAC 40 (+0.0%) and the German DAX (-0.3%).

- The CBOE VIX (volatility) index fell to 23.7 points.

- Wall Street disagrees: the S&P 500 (+0.2%), the Dow 30 (-0.3%) and the Nasdaq (+0.4%).

- The euro is up 0.3% and is trading at 1.021 against the US dollar.

- Gold (+0.9%) and silver (+0.6%) are required.

- Oil: WTI (-3.3%) and Brent (-3.4%) are down.

- Bitcoin (-4.6%) is dropping significantly.

Aldmarq:

- As one of the largest in Europe, there are few investment banks ASML (+5.2%) Not following. The feeder got the needed changes in the target price around his ears today. Even Bank of America raised its advice from comment to buy. The rest of the target price changes and associated tips can be found below.

- The AEX (+1.5%) closes again above 700 pips. We haven’t seen them for nearly a month and a half.

- Meanwhile, Citi Research lowered its target price by Just eat takeaway (-0.0%) Very radical: from 145 € to 37 €. Of course, it should be noted that €145 goes back to July 2021, when meal delivery was still trading around €77. Well, the world of Just Eat Takeaway contributors looked very different. However, this new €37 target price comes with tough buying advice, as Jitse Groen closed the day at €16.32.

- Arcelor Metal (-0.2%) and auto parts maker Gestamp made auto parts from low carbon steel. Carbon dioxide emissions will be approximately 70% lower than the average for steel, due to the reuse of the metal and the use of renewable electricity.

- Alberts (+5.9%) of the biggest protestors today. During the first six months, Alberts’ organic growth increased to 9.8%. This means that the company has overcome all obstacles in the SuppliersHigh inflation and staff shortages were more than they could handle. Also Read Expanded Alberts analysis.

- Flow Traders (+3.3%) will publish its quarterly results on Friday, which are expected to be significantly lower than the previous quarter and year, due to lower margins. This is evidenced by the forecasts of the two boards of analysts consulted by ABM Financial News.

- zellige (-2.1%) posted a solid rebound in revenue, but on the bottom, the profit is somewhat disappointing. This is the opinion of analyst Peter Schott. For more information, read his full analysis of Sligro.

- shot They also engraved the forms of Achterhoekse needap (-0.2%). The company is growing rapidly. The demand for the company’s technological solutions from Groenlo continues to increase and this applies to almost all parts. According to Schott, the 12% sales growth in the first half of the year – completely independent because Nedap rarely acquired it – can be described as very high.

advice

- ASML: to €743 from €733 and increase to purchase – Bank of America

- ASML: up to €525 from €475 and keep it – Deutsche Bank

- ASML to 815 euros from 845 euros and buy – Berenberg

- ASML: to €920 from €960 and buy – Credit Suisse

- ASML: Buy recommendation with a target price of €780 – JPMorgan Research

- AkzoNobel: to €88 from €105 and keep it – JPMorgan Research

- AkzoNobel: up to €87 from €100 and buy – Goldman Sachs

- Adyen: to €2600 from €3600 and buy – Goldman Sachs

- Pros: up to €90 from €75 and buy – UBS

- Wolters Kluwer: up to 120 euros from 115 euros and buy – Morgan Stanley

- Just takeaway: up to €37 from €145 and buy – Citi Research

Agenda for Friday, July 22, 2022

08:00 Wereldhave numbers Q2

08:00 Accell Q2 numbers

08:00 Better Bed Q2 Numbers

08:00 Merchants numbers in the second quarter

09:30 German Manufacturing PMI Jul

09:30 PMI German Services Jul

10:00 EU Manufacturing PMI Jul

10:00 PMI EU Services Jul

13:00 American Express Q2 Numbers

13:00 Verizon Q2 numbers

Coen Grooters is the IEX editor. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. click here For an overview of IEX editors’ investments.

“Lifelong zombie fanatic. Hardcore web practitioner. Thinker. Music expert. Unapologetic pop culture scholar.”