Listen to the audio version of this article below

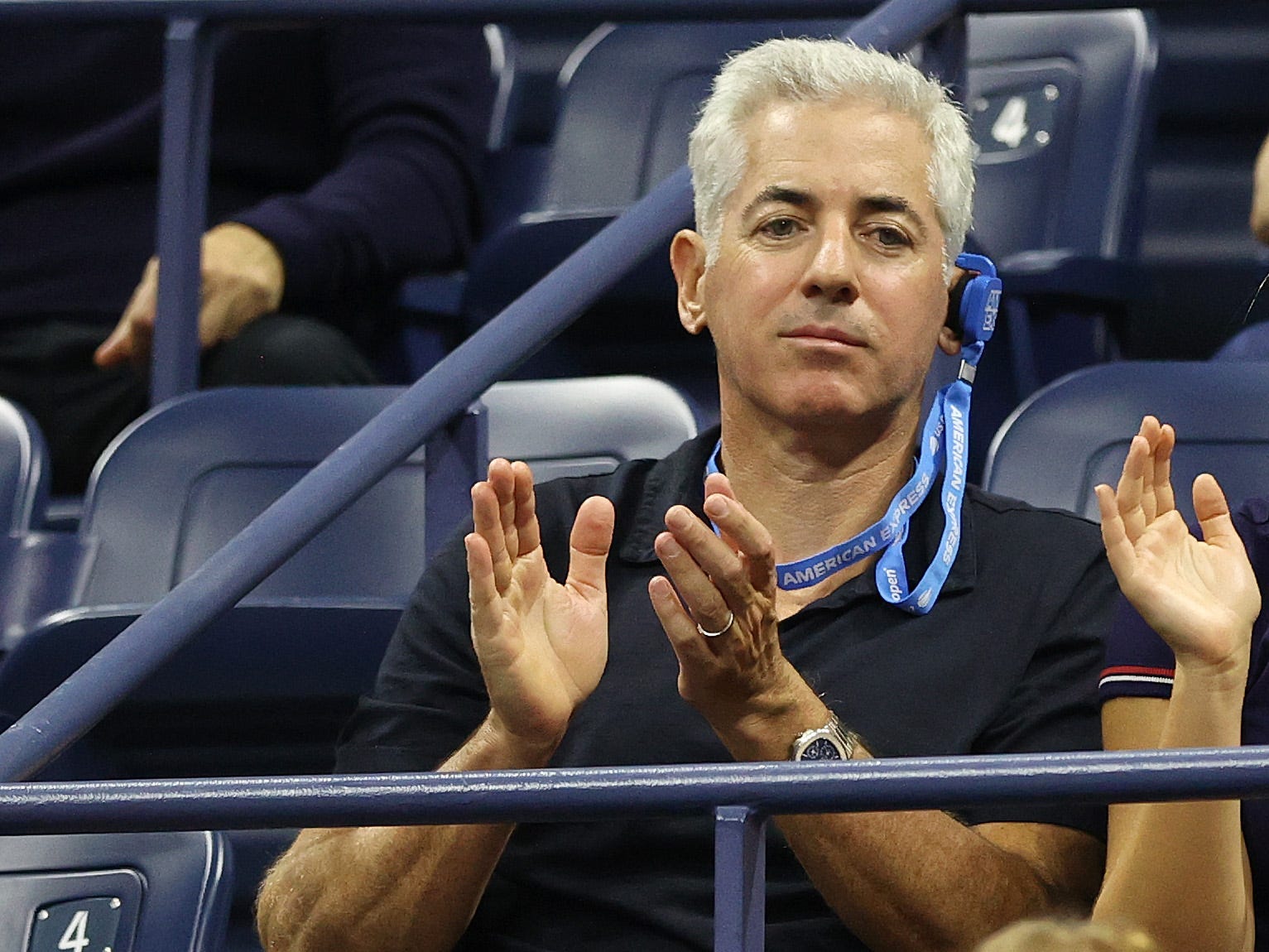

- Leading investor Bill Ackman believes the Federal Reserve should come up with a big rate hike to restore the central bank’s credibility in the eyes of financial markets.

- According to Ackman, the central bank is failing in its war on inflation, which is at a 40-year high.

- Investors expect at least four tariff hikes in 2022.

- read more: Wall Street interest rates have fallen sharply due to concerns about an increase

Phil Ackman, US hedge fund manager, believes the US Federal Reserve should bring in a large rate hike to restore its credibility and convince financial markets that the Federal Reserve is serious about combating high inflation.

“From Federal Reserve Ackmann wrote: A series of tweets. It will “show determination to tackle inflation,” he said.

According to Ackman, the Federal Reserve is failing in its fight against inflation. In the United States, it has risen to its highest level in nearly forty years, partly due to a shortage of raw materials and labor.

Auckman believes the central bank is lagging behind and warns of “painful economic consequences for the most vulnerable”. He doubts whether three or four tariff hikes this year will be enough.

Financial markets expect the Federal Reserve to raise interest rates four times this year. CME Team FedWatch, Starting with a 0.25 percent increase in March.

Big banks like Goldman Sachs and Deutsche Bank Expect Four tariff hikes this year. Jamie Demon, chairman of JPMorgan, even thinks the Fed will cut interest rates until this year. Seven times Can increase.

There is US inflation The highest level in almost forty years Reaches. The U.S. Consumer Price Index (CPI) was up 7 percent last December. This is the largest increase in the 12 months since 1982.

There have been no significant tariff increases in the United States since 2000

The Federal Reserve has not raised interest rates by more than 25 basis points (0.25 percent) simultaneously since 2000.

In the spring of 2020, following the corona virus epidemic, the central bank cut its core interest rate, the Federal Reserve, from 0 to 0.25 percent, an all-time high.

According to Ackman, an unexpected 50 basis point increase (0.5 percentage points) could avoid the need for more drastic action in the future.

“The first move of 50 basis points will have a mutual effect from lower expectations for inflation,” he tweeted. “This will reduce the need for more aggressive and economically painful measures in the future.”

Federal Reserve Chairman Jerome Powell said last week Higher interest rates Further tight monetary policy is needed to control inflation. According to him, the US economy is strong enough to withstand both.

read more: Are central bank hawks going to make the lives of stock investors worse in 2022? Notice these symptoms