AP

NOS . News••modified

-

Charlotte Klein

Editing Economics

-

guram puglia

Online Editor

-

Charlotte Klein

Editing Economics

-

guram puglia

Online Editor

Is it Rabobank’s fault? The Bank is by far the largest financier of the agricultural sector in the Netherlands and is therefore partly responsible for the development of the nitrogen crisis, according to political parties, social organizations and Bank partners. Rabobank itself seems to be playing its part with caution to confess: “Knowing now, you would have acted really differently in the past.”

This approach has been marked for decades by stimulating the intensification and expansion of agriculture. But the increase in volume was “published by the government” and took place “within the market conditions created by society,” the bank immediately objected.

How much should rabobank dissolve in her milk? We explain this in three questions and graphs.

Why did agriculture in the Netherlands intensify so much?

The origin of intensive agriculture dates back to shortly after World War II. First, the Dutch – and then European – policy was to stimulate efficiency and economies of scale. Thus, hunger had to be eradicated forever.

Through export subsidies, import duties, land consolidation and technical innovation, small farms have given way to the big players, with an emphasis on higher production. Motivated by European subsidies, more was produced than was required, giving rise to the well-known milk lakes and butter mountains.

In 1984, to prevent this overproduction, a European quota of milk was agreed upon. This will last 31 years. The average price of milk has remained more or less the same in all those years, while in 2022 you can buy half for the same amount.

Thus, the milk production of farmers is relatively lower than in the past. Therefore continuous increases in volume and densification are necessary in order not to deteriorate. After the milk quota was abolished in 2015, this process accelerated further, with more livestock and more massive stalls per farm.

40% of nitrogen emissions come from agriculture, which means that the sector contributes significantly to the deposition of nitrogen in nature. Livestock farming leads to emissions of ammonia, a harmful nitrogen compound, and an important cause of the nitrogen crisis. Ammonia emissions have declined since 1991. This decline has stagnated between 2013 and 2017, due in part to the elimination of the milk quota.

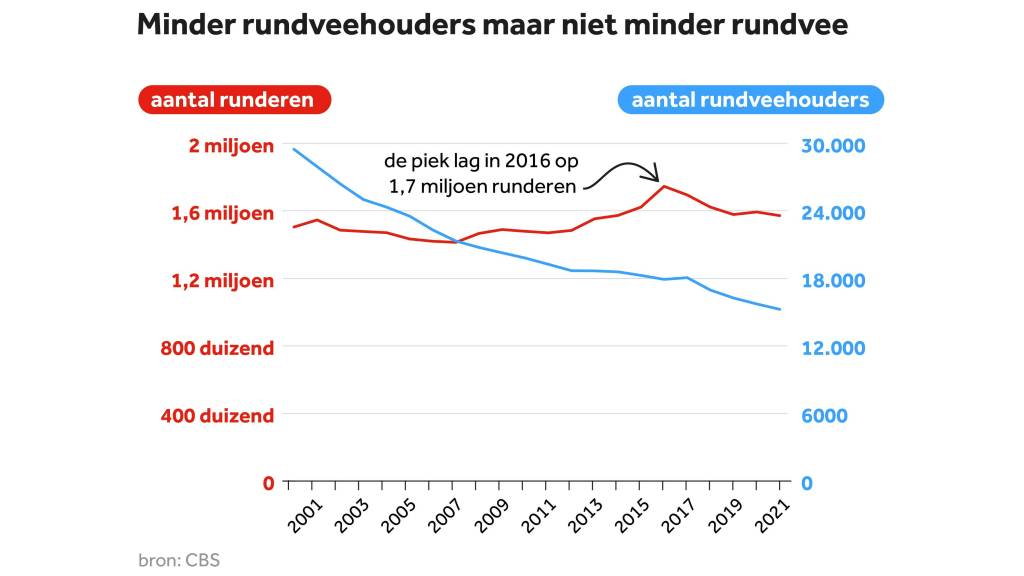

Intensification of dairy farming can be observed in the decrease in the number of farms, while the number of cows remains more or less stable:

NOS

What is the importance of Rabobank in financing the agricultural sector?

To pay for these large stables and other equipment, farmers have to borrow money from banks. Rabobank says it finances about 85 percent of all companies in the agricultural sector.

You don’t see numbers like this in almost any other sector. This farmer says:

“The block is a cash register, Rabobank strongly encouraged this”

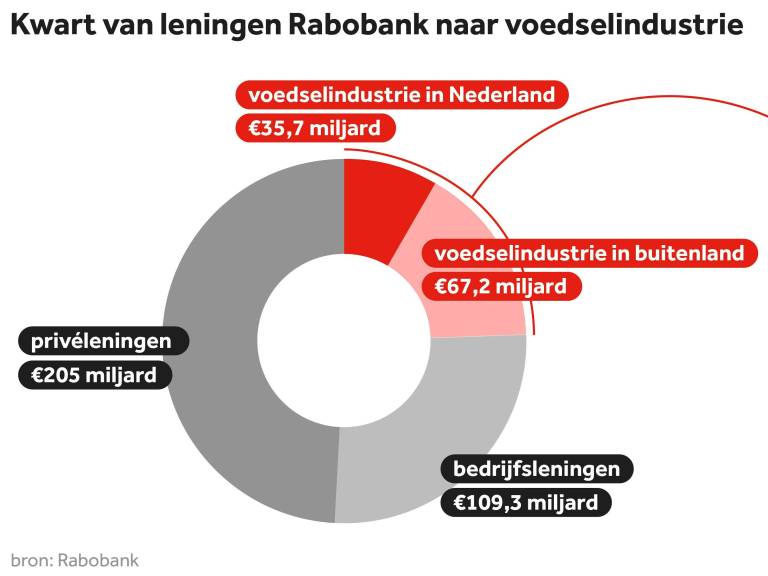

For the bank, the agricultural sector is one of the most important clients. From the annual report.PDF) shows that a quarter of Rabobank’s loans go to the food and agriculture sector – see the first graph below. Please note that these are loans to Dutch and foreign companies. Rabobank is also one of the largest financiers of the food industry worldwide.

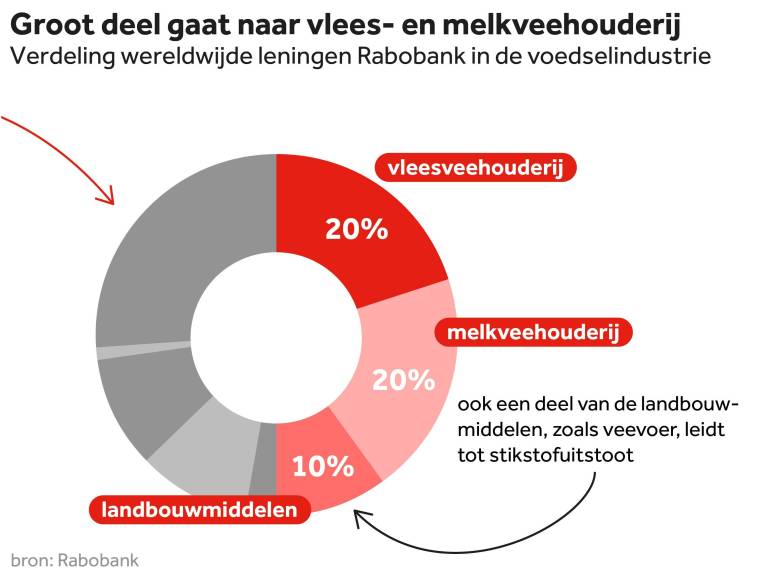

Food and agricultural include not only agriculture, but also, for example, the supermarket sector and commodity trade. Of the 103 billion euros paid by “Rabobank” around the world It has outstanding food and agricultural loans, a large part of which goes to dairy and beef raising – see Figure 2 below.

These sectors are the largest contributors to nitrogen emissions in agriculture. In the second chart below, Rabobank makes no distinction between loans in the Netherlands and abroad.

-

NOS

-

NOS

What does Rabobank invest in sustainable agriculture?

Rabobank is proud of the fact that 75 percent of all organic farmers are its customers. At the same time, only 4 percent of agriculture in the Netherlands is organic. In the absolute sense, then it is only a small amount: the bank He said last year To invest about 1 billion euros in sustainable agriculture.

Rabobank also says that farmers who invest in sustainability get a discount on the interest they pay on the loan. In addition, there is public investment in innovations that should reduce ammonia emissions, for example. According to the World Wildlife Fund (WWF)As a partner of the bank for many years, these innovations offer a false sense of security, because it is better to tackle the problem at the source.

Countless stories from farmers raise questions about Rabobank’s sustainable ambitions. Books farmers who want to get membership often do not get a loan de Volkskrant And the Norwegian Refugee Council. If you want to run a profitable organic business as a farmer, your product prices must go up. According to the bank, not enough customers are willing to pay for it.

In the annual report, Rabobank’s internal ethics committee criticized this position as well as promoting economies of scale. Upgrading is more appropriate in financial considerations for account managers, because they work with generic risk models. Based on this, the bank considers that growing your company is less risky than making it more sustainable. The Ethics Committee is calling for more customization.

Rabobank sees a way forward mainly in consultation with the whole sector, without announcing concrete changes in its own policy: “There is no doubt that it must be more sustainable and this requires an extra step from farmers, consumers and from us as a bank.”