The AEX is expected to open lower, despite new records on Wall Street.

Two reports with better-than-expected numbers and one profit warning are the harvest before the stock market opens. So a mixed bag. This also applies to signals coming from outside. Wall Street set new records last night, but Intel has yet to come up with disappointing numbers. Asia closed mostly lower, with many technology stocks under pressure.

PostNL Profit Warning

PostNL comes – not for the first time – with profit expectations. The operating result is expected to reach €92 million in 2023, compared to the previously announced €100-130 million. Pain with firmness. This was also a concern in the third quarter. Delivery is also difficult due to high absenteeism, which puts further pressure on costs.

PostNL will provide full figures on February 26.

Signify boosts margins

Signify reported a decline in sales volume, but more importantly increased margin faster than expected, thanks to cost savings. The margin was 12.1%, compared to 10.7% in the third quarter and 10.2% in the previous year. Analysts had expected 11.7%.

WDP sees earnings growth and offers a multi-year plan

WDP, active in real estate logistics, saw its so-called EPRA profits increase by 12% year-on-year. If we deduct one-time items, an increase of 8% remains. The outlook is also positive. The company proposes a dividend of 1.18 euros for 2024, which is 6 cents more than analysts expected.

WDP is also laying out a four-year plan to increase profits. The plan provides for investments worth 1.5 billion euros.

Asia closed mostly lower

Then to the trade shows around us. Records were set on Wall Street last night (see below), but Asia clearly struggled to pick a direction. The Nikkei, which started the year well, faced several days of headwinds and lost more than 1% today. Wally Bank of Japan He once again hinted that ultra-low interest rates will not be sustainable forever, especially as inflation slowly creeps towards the desired 2%.

China is heading south again after a recent recovery. Investors appear to be wondering how many additional training wheels will be needed to boost economic growth. Only in South Korea price boards turn green.

The positions of the most important indicators are as follows:

- Nikkei 225 -1.3%

- Shanghai Shenzhen CSI 300: -0.1%

- Hang Seng (Hong Kong): -1.4%

- Cosby (South Korea): +0.3%

Several technology stocks came under pressure last night. Alibaba.com It lost 3.4% of its Prosus stake Tencent He lost 2.8% of his value in the stock market and was forced to move to South Korea Samsung Give away 0.7%. Just TSMC (+0.3%) keeps powder dry.

Wall Street: S&P 500 and Dow hit records

Wall Street had a great day on Thursday, with the S&P 500 and Dow Jones both hitting new records.

The Dow Jones index rose 0.6% to 38,049.13 points. The Standard & Poor’s 500 index rose 0.5% to 4,894.16 points. The Nasdaq index rose 0.2% to 15,510.50 points.

This was mainly due to Tesla. Disappointing numbers and disappointing forecasts sent prices down more than 8% in after-hours trading on Wednesday. Another 12% collapsed on Thursday, bringing the total to approx 80 billion dollars The value of the stock market has gone up in smoke. Since the beginning of the year, the price has already fallen by more than 26%.

#Tesla Shares fell 12% on worst trading day since 2020 after the automaker warned of a slowdown. pic.twitter.com/8o8cm70KXR

– Holger Schäpitz (@Schuldensuehner) January 25, 2024

As always, one man’s death is another man’s bread. Short sellers have taken in more than $2 billion since Wednesday evening, Ortex Media reported.

Does the recent price penalty provide a great buying opportunity? Or better to stay away from it, according to the slogan “Never catch a falling knife.”? IEX analyst Ivo Broekink’s view can be found here.

Unlike what Tesla got IBM Investors depend on banks. The numbers were better than expected and expectations clearly left room for more: the price rose by 9.5% yesterday.

Boeing The company was forced to give up nearly 6% after regulators imposed restrictions on production of the 737 MAX. However, the grounded planes will soon be able to take to the air again.

…But then Intel came along

After Wall Street closed Intel Corporation Connect with numbers. These expectations exceeded market expectations, but the outlook for the first quarter was significantly disappointing: the price fell 10.9% in after-hours trading.

also visa Investors couldn’t get their act together regarding the quarterly numbers: the price fell 3% in after-hours trading, despite better-than-expected numbers.

Has a US recession been avoided?

Investors were also able to respond to the first estimate of US economic growth in the fourth quarter. This figure was much better than expected: it turned out that GDP rose by up to 3.3% year-on-year, while the market expected a 2% increase. This reinforces investors’ hopes that the United States can avoid a recession despite a series of interest rate hikes last year.

The Federal Reserve is expected to start cutting interest rates next spring. Next Wednesday, when the Fed makes its first interest rate decision this year, it may still be too early to make that decision. March will be difficult. But according to the market, it will definitely happen in May.

In this regard, financial markets will be watching with interest the development of personal consumption expenditures inflation at 2:30 pm today.

Indicators:

- European futures colors are divided

- In Asia, price boards are mostly red.

- The CBOE VIX (volatility) index falls to 12.55

- The euro fell by about 0.1% against the dollar and is trading at 1.0829

- The Dutch 10-year interest rate fell by 4 basis points to 2.57%. The American loses 3 basis points and ends at 4.10%

- Gold was slightly higher at $2,021.79 per ounce.

- Oil prices are falling slightly. The price of West Texas Intermediate crude oil is $76.79 per barrel.

- Bitcoin rose 0.4% to $40,100.81.

The AEX index is expected to open 0.4% lower.

News, advice, shorts and agenda

Top stories from ABM Financial News:

- 07:40 Corbion sells US emulsions business to Kingswood

- 07:35 Strong earnings growth and good prospects for WDP

- 07:28 PostNL warns of disappointing numbers

- 07:20 Lower turnover but higher margin for Signify

- 07:19 Asian stock markets divided

- 06:49 European stock markets open divided

- 06:42 Exhibition agenda: Dutch companies

- 06:42 Stock Market Agenda: Foreign Funds

- 06:42 Stock Market Agenda: Macroeconomics

- January 25, Levi reduces costs

- January 25 Higher results visa

- January 25 Disappointing Intel forecast

- January 25 Wall Street breaks records

- Stock Market Update January 25: AEX on Wall Street

- January 25 The Federal Trade Commission (FTC) is investigating artificial intelligence investments by major US technology companies

- January 25 Oil prices rise sharply

- January 25: Wall Street loses steam

- January 25: European stock markets rebound after the European Central Bank’s interest rate decision

- Update January 25: Stock Market View: The Fed has plenty of room to cut interest rates

- January 25 LVMH strong growth

- January 25 HAL announces 2023 dividends

IEX also produces an overview of the most important news stories in the morning newspapers each morning. You can find that overview here.

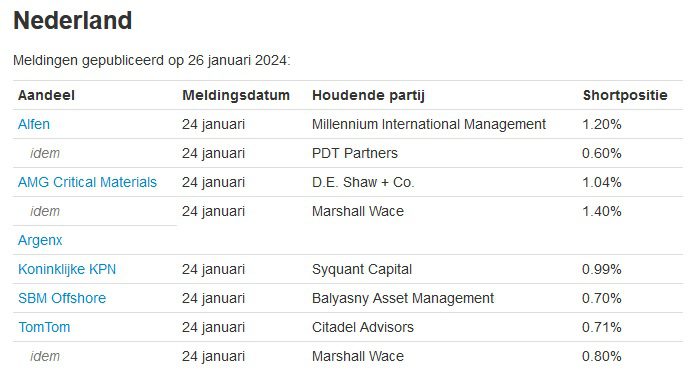

AFM reports this Shorts.

advice

Reduce one recommendation for IMCD and increase target price for ASML. The average price target of analysts is €894, which equates to an upside potential of 10.6%.

- IMCD: From €144 to €140 and downgrade advice from buy to hold – KBC Securities

- ASML: €853 from €750 and buy – Cowen & Co

- ASML: to €876 from €782 and buy – Wells Fargo

Agenda: Watch US PCE inflation at 2:30 p.m

Earnings season is also starting to improve in the Netherlands. numbers Signify And WDP I’ve already seen it.

This afternoon after lunch American Express And Colgate-Palmolive Role.

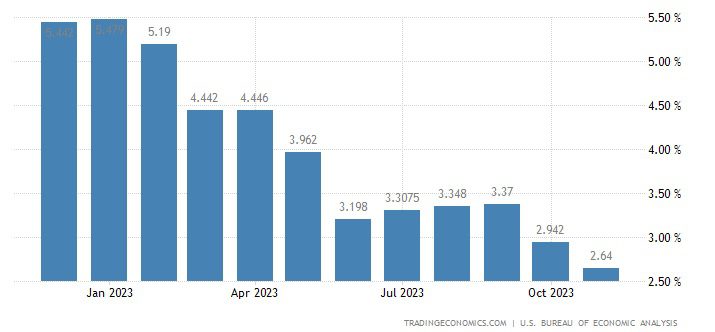

Probably the most important event today is the American event Core PCE inflation About December. This is inflation without energy and food prices, which is the most important number the Fed looks at in its interest rate decision.

This number was a windfall last month: a 0.2% month-on-month increase was expected, but it turned out to be +0.1%. The year-on-year figure fell from 3.4% in November to 3.2% in December.

The normal inflation rate for personal consumption expenditures fell from 2.9 to 2.6%. Although this is still above the Fed’s 2% target, the trend is clearly downward.

Economists expect core personal consumption expenditures to reach 0.2% monthly and 2.6% annually in December. This would be too high for it to be able to reach the desired 2% on an annual basis. To reach this 2% annual rate, the PCE inflation rate must rise by a maximum of 0.17%.

Tomorrow’s monthly data is also likely to confirm that the monthly increase has fallen below the crucial 0.17 percent threshold for the sixth time in seven months. This is the ratio we need to achieve in 12 months to reach 2% on an annual basis

This afternoon: IEX member Hildo Lamann on Bulls & Bears on SBS6

Hildo Lahmann, Head of Investors Desk at IEX, joined the Bulls & Bears TV show this week to talk about the latest developments on the stock exchange and the upcoming stock market week.

He talks about, among other things, ASML (which released the figures on Wednesday), Ibusco (which hopes to get the green light from shareholders on Monday to issue new shares and issue convertible bonds) and Philips, which will present its annual numbers on Monday.

You can watch the broadcast on SBS6 channel at the following link:

- This afternoon at 3:10 p.m

- Saturday at 12:00 noon

- Sunday at 10:00 am

Then this

my darling…

this ?? https://t.co/ijlOzJ3Bvf

– Jeroen Blokland (@jsblokland) January 25, 2024

HSBC expects “severe pressure” in commodities

Commodity markets are under “extreme pressure” – and high prices could persist https://t.co/Etzx01CuTZ

– CNBC (@CNBC) January 26, 2024

Is electric driving doomed to fail?

He points out that outside of affluent and fashionable communities, consumers are passing up electric cars and opting for hybrids and gasoline engines instead. @econtod. https://t.co/TriaW8tGO1

— Project Syndicate (@ProSyn) January 26, 2024

Consumption in China

China’s Ministry of Commerce has declared 2024 a “consumption boost year” even as foreign companies appear pessimistic about the outlook for this year. https://t.co/qF34kaoeGF

– Bloomberg Markets (@markets) January 26, 2024

Good luck today!

“Lifelong zombie fanatic. Hardcore web practitioner. Thinker. Music expert. Unapologetic pop culture scholar.”