AP

Mass layoffs at Philips and Aldel, rising unemployment for the first time in two years, waning producer and consumer confidence: what many people are already feeling in their wallets is now also clear from the official figures.

“I think we’re past the tipping point and we’re in a mild recession, we don’t really know if it will develop further into a strong recession,” said Marieke Blum, chief economist at ING. news hour.

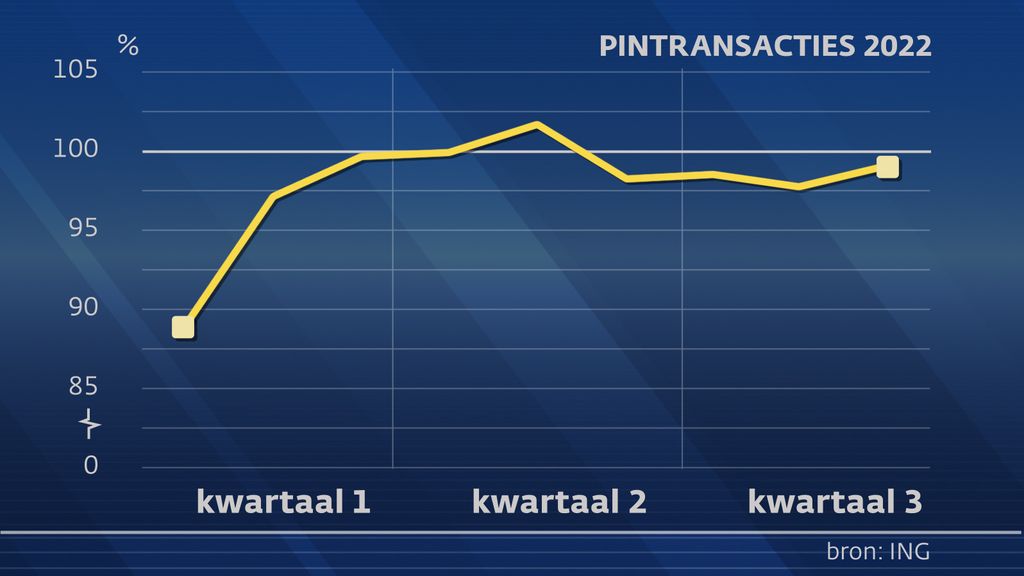

PIN Transactions

I came to this conclusion due to a number of economic indicators that appear in red. “The first thing we look at is what consumers are doing now,” Blom says. ING does this by looking at debit card transactions for people with a bank account. This gives a picture of how total consumer spending has developed in the Netherlands.

“We see that consumer spending rose significantly in the second quarter after we were still on lockdown in the first,” Blom says. “The second quarter was a very good quarter. But in the third quarter we see that consumer spending is down somewhat again.”

a job

ING can only tell how many euros people spend, not how much they buy with it. The latter is basically what economists care about. As everything becomes more expensive, that number will drop more than a one-and-a-half percent drop in the graph.

This still seems like a relatively modest dip. “But typically, as economists, we really fall out of our seats if there’s a one-percent change in the quarter,” Bloom says. This means a significant change in economic conditions for us.”

Business

Of course, what consumers do also has an impact on businesses. To be able to say something about this, ING looks at product confidence. “We do this by asking companies how many orders they have received in the past few months,” Blom says. “In the companies that answered this, we saw that the recovery arose after Corona.”

a job

During that period, the line in the chart will rise above 50. “The moment the price drops below 50, it means that the companies said, ‘We have now received fewer orders than in the previous period,'” Blom says. At the last point in September, producer confidence fell to 43. “If we look closely at the data, we see that the companies that are struggling are basically production companies, which need a lot of energy.”

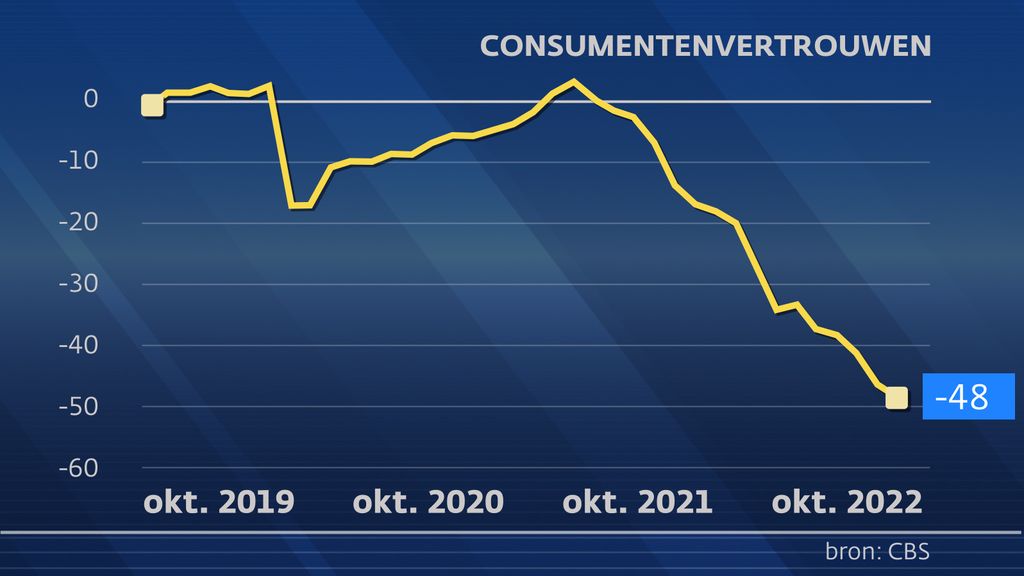

so trust me

Another reason for Blom to talk about a recession is declining consumer confidence. “It’s really at an all-time low now, it’s never been this high before. It’s about the question: Are you willing to buy or sell something? People are saying now: I can’t afford it, because everything is getting more expensive and my income is not increasing depending.” So “.

a job

The fact that Blom is only talking about a mild recession has something to do with the fact that things are going well, too. “For example, employment is still at a high level. But the future is very uncertain: it depends, for example, on what kind of winter we will have and whether gas will become more expensive.”

Whole warehouses

The changing economic situation is already noticeable in the port of Rotterdam. Warehouses are overcrowded due to collapsing demand. “It is fully occupied, and there is no space left for pallets,” says Kono Vatt, CEO of Neele-Vat Logistics, as he walks into one of his large warehouses in the port of Rotterdam. “This makes it difficult to help new customers.”

The building was completed in June, but to his surprise, it was already filled to the brim. “The same goes for our other warehouses, they are all fully used now.”

“Stock fillers are also good news somewhere,” says economist Renz van Tilburg. He is director of the Sustainable Finance Lab, an academic research center focused on the more sustainable use of public financial resources. “For a long time it was hard to get the products we were looking for and prices went up as a result. Now it could also work another way: people want to sell things, which could drive prices down.”

response to the situation

A “little slack” might not be a bad thing either, says Van Tilburg, due to a massive labor shortage. “So it’s okay if the economy calms down a bit. What we need to prevent is that the recession becomes very long and deep.”

According to him, this risk exists if the important players in the economy, such as central banks and governments, do not respond adequately to the situation. “If they don’t see prices really coming down on their own and they keep raising interest rates or cutting spending, the recession could get much worse and hurt a lot.”

Kono Vat, chairman of Neele-Vat, a logistics provider, noted that it’s easier to find employees. “Up until the summer, we had a lot of difficulties finding employees in all areas. Especially in the warehouse with forklift drivers and order pickers. We’ve had more success with this recently.”