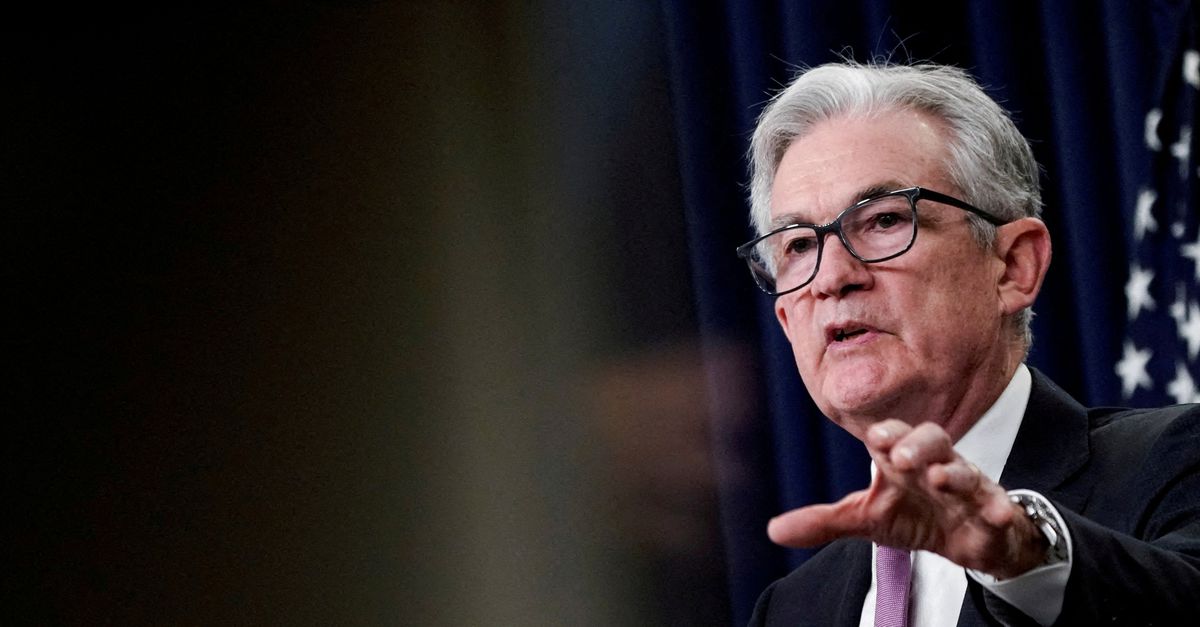

The Federal Reserve, America’s central bank, raises interest rates and keeps them high until inflation declines. This policy will lead to low economic growth and labor market deterioration. Federal Reserve Chairman Jerome Powell made the announcement in a speech on Friday at the annual meeting of central bankers and scientists from around the world in the US city of Jackson Hole.

In a speech eagerly awaited by financial markets all week, Powell mainly sought to allay concerns that the central bank will cut interest rates too soon, now close to 9 percent year-over-year, as high inflation begins to fall. Powell emphasized that price stability, commonly defined as inflation of 2 percent, was the “foundation” of the economy. Getting back to that level, he says, will take time and “intensive” use of the tools available to the central bank — particularly money market rates.

4 percent interest

This year, the central bank has already raised its key interest rate from nearly 0 percent to 2.25 to 2.5 percent. Powell pointed out that the median expectation among Fed members is that interest rates will be closer to 4 percent next year. According to him, today’s high inflation should be prevented from becoming permanent, and then it becomes very difficult to reduce it again.

read more: Monetary Crisis: Sacrificing Jobs to Control Inflation?

Powell repeatedly noted that inflation was also high in the 1970s. The central bank’s delayed response required a policy of large interest rate hikes, after which interest rates would remain relatively high for 15 years to structurally lower public and business inflation expectations.

In the eurozone, inflation is close to 9 percent, and the European Central Bank (ECB) has taken it pretty easy so far. The ECB raised interest rates in July from 0 percent to 0.5 percent.

A version of this article appeared in the August 27, 2022 issue of the newspaper