Feelings are bad now. After a slightly higher opening, the AEX (-0.8%) closed again sharply in the red. Tensions between Russia and Ukraine are escalating again, and then there are traders who would rather not take their stocks this weekend.

Don’t be fooled

However, in my opinion, conflict is not a long-term stock market event. You don’t think we’d cut back on shopping at Albert Heijn if Russia invaded Ukraine, would you? Or are we ignoring the gyms?

The best thing you can do as an investor in this type of situation is to do nothing. After all, we can’t predict how the conflict will end and even in the worst case scenario, companies are still making money for their shareholders.

Once again, unprofitable growing companies were the hardest hit. Just eat takeaway (-7.0%), in publishing (-4.4%) and CM.com (-4.2%) Completely destroyed. In the Today’s podcast I explain that there is indeed value in the latter you sit down.

On the other hand, there are winners too, so pops Fugro (+17.9%) up on strong corporate numbers. After years of illness, the soil researcher is starting to see growth again. Last quarter sales increased by at least 24% and margins improved as well. I can’t say if this is the beginning of a turnaround. The company has been disappointed several times in the past because of this.

Next to

Fourth quarter numbers Next to (+3.5%) They have relatively few surprises. Although sales were down 17% quarter-over-quarter, such declines in the fourth quarter are not uncommon. After all, it is traditionally the weakest quarter-slicer from Duiven.

Furthermore, fourth-quarter orders are positive and Besi will pay more than €3.33 in dividends for fiscal 2021. This means a dividend yield of 4.2%. The stock is currently trading at fifteen times the expected profit for 2022. You can read in the article below whether the stock is worth buying.

Bessie: Double your dividend #BESI https://t.co/GoYyhO2Ucd

IEX Investor Desk February 18 2022

Heijmans

where bam (-2.5%) are regularly involved in large projects, and the results are remarkable Heijmans (-3.4%) little error. Although turnover remained stable at 1.75 billion euros last year, EBITDA increased by at least 25%. In short, margins are on the rise.

Although material costs have risen sharply, this has been offset by rising housing prices. Thus, the real estate division is currently the most profitable activity of Heijmans.

Another difference with BAM is Heijmans’ strong capital position. While BAM’s solvency ratio remains at 14.5%, Heijmans has achieved a score of 30%. The latter can provide for its shareholders and do so. The originator proposes a dividend of 0.88 euros per share.

You can read in the article below whether the results are enough to recommend a purchase.

Heijmans positively on his way to his centenary #higmans https://t.co/ed2HbnjSSF

IEX Investor Desk February 18 2022

Interests

Ten-year government bond fees are broadly declining today. We are currently in risk the situation.

- Netherlands: -0 basis points (+0.47%)

- Germany: -3 base points (+0.20%)

- Italy: -1 basis point (+1.84%)

- United Kingdom: -6 basis points (+1.39%)

- United States: -4 basis points (+1.93%)

Weekly Lists

- AEX this week: -2.2%

- AEX this month: -1.4%

- AEX this year: -6.7%

- AEX reinvestment index this year: -6.4%

all of that

Almost all stock indices lost some of their gains this week. damage in Nasdaq (-1.4%) Not that bad at first glance, but that’s because the pain was already taken up on Friday of last week. Moreover, the sharp drop in the price ASCX (-3.4%). The trigger is the negative estimate receipt from the originator bam (-16.5%).

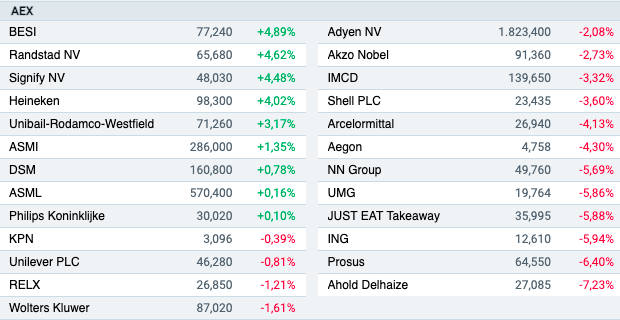

AEX

The twigs are in good shape this week. Not so often Next to (+4.9%) is the best AEX fund in a falling market. On the other hand, I hold (-7.2%) Multiplication. Traditionally, management has expressed an unprecedented cautious outlook. NN . group Surprised (-5.7%) with a strong €1 billion share buyback programme, but sentiment among insurers has been poor this week.

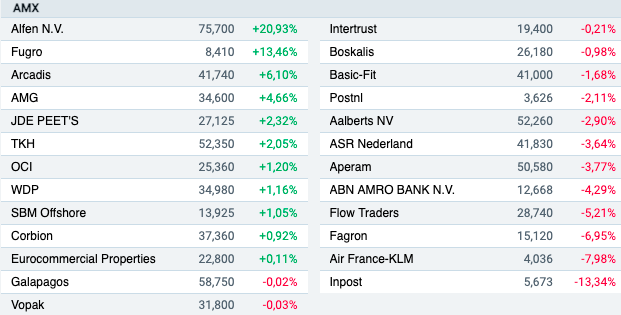

AMX

two thousand (+20.9%) expects to grow by 40% this year which is a resounding surprise. Given the problems in the supply chain, no one expected the acceleration of growth in the energy specialist. Last year, the company managed to increase its sales by 32%. Fugro (+13.5%) finally managed to deliver good numbers for the fourth quarter. The soil researcher notes that over 60% of the stock market’s value has evaporated over the past five years.

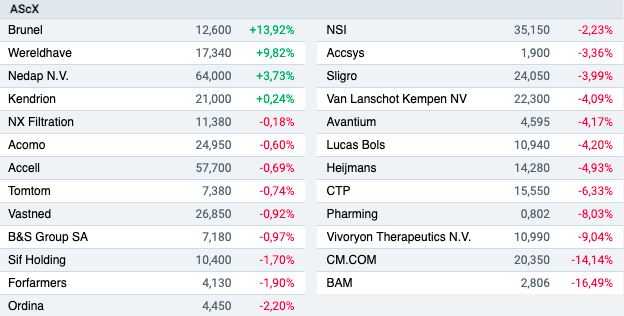

ASCX

profitability Brunel (+13.9%) came in higher than expected and the company also declared a dividend of €0.45 per share. This means that the dividend yield is close to 4%. bam (-16.5%) was again forced to make a significant reduction on Afsluitdijk, although this has not yet been officially announced. The problem is that no one knows how many debts will follow.

Finally, I wish you a happy weekend. Arend Jan is previewing this week.