According to the international media, the virus outbreak in China marks an economic downturn, while the economies of the United States and the European Union have demonstrated resilience. However, data on inflation, commodity crises and misinformation wars in Western countries tell a different story.

In the West, the international media portrayed China’s outbreak of Omigron disease as a means of transformation, reflecting the decline of the landscape. Will pressure on China, as some have said, lead to the proposed infiltration of foreign multinationals? The answer is no.

In 2021, China’s real foreign direct investment (FDI) utilization was over $ 173 billion, an increase of 20.2 percent in annual dollars. In the first two months of this year, FDI inflows increased by 45.2 per cent year-on-year to $ 37.9 billion.

Since the beginning of March, the Omigran eruption has spread from Shanghai to other parts of China, including Beijing, Guangdong and Hunan provinces. So, how is China’s epidemiological performance compared to other countries?

Media focus and realism

When the Govt-19 eruption in China was contained in early 2020, the number of confirmed cases worldwide was about 3 million. Two years after the outbreak, the global population was 516 million. There are more than 84 million confirmed cases in the United States alone, although the actual number is much higher. About 60 percent of Americans are infected with the virus, according to the U.S. Centers for Disease Control and Prevention.

The failure of Washington and Brussels to control the epidemic, with adequate international cooperation and vaccine stockpiles in rich countries, has created waves of new variables. A common feature of these recent crises is the end of locks, the opening of economies and the increase in international travel.

China is no exception, but it has a proven track record of rapid response and economic recovery.

Here are the facts: Countries that have been hit hardest by small and open trade economies, such as Denmark (Rank 5) and the Netherlands (Rank 9), by population; Major economies, including France (14th), United Kingdom (38th), and the United States (57th). This figure is lower for developing countries such as Japan (129th) and the Philippines (146th) and India (150th). But China (223) is lower on the list. There are 152 cases per one million people compared to 249700 cases in the United States (Figure 1).

Figure 1 Overall confirmed COVID-19 cases per million population

Source: Johns Hopkins University CSSE Covit-19 data, May 7, 2022.

In light of these facts, the argument that the magnitude of the Omigron eruption in China is greater than the epidemic catastrophe in the West is completely false.

Destructive headwind

The counter-argument is that China occupies such a prominent place in international value networks that the severe turmoil in Shanghai, Beijing and Guangdong will have global repercussions. This is certainly true, but it also applies to foreign multinationals, led by the United States, European countries, and Japan, who have experienced painful setbacks during epidemics.

It is clear that the gradual shutdown of Chinese economic centers presents new challenges, including a slow recovery in the automotive sector and an increase in dizziness in the electronics sector. The recession is already seen in the sharp fall of March BMI with weak import growth.

Due to the country’s primary role in global supply and distribution, the impact of tensions on the global supply chain is significant in China. However, other economies will experience strong dizziness over time. The US Federal Reserve recently raised interest rates by 0.50 percent, the largest increase in 22 years. As the BoE is likely to follow in the footsteps of the central bank, the European Central Bank will increase pressure to launch its rate plan.

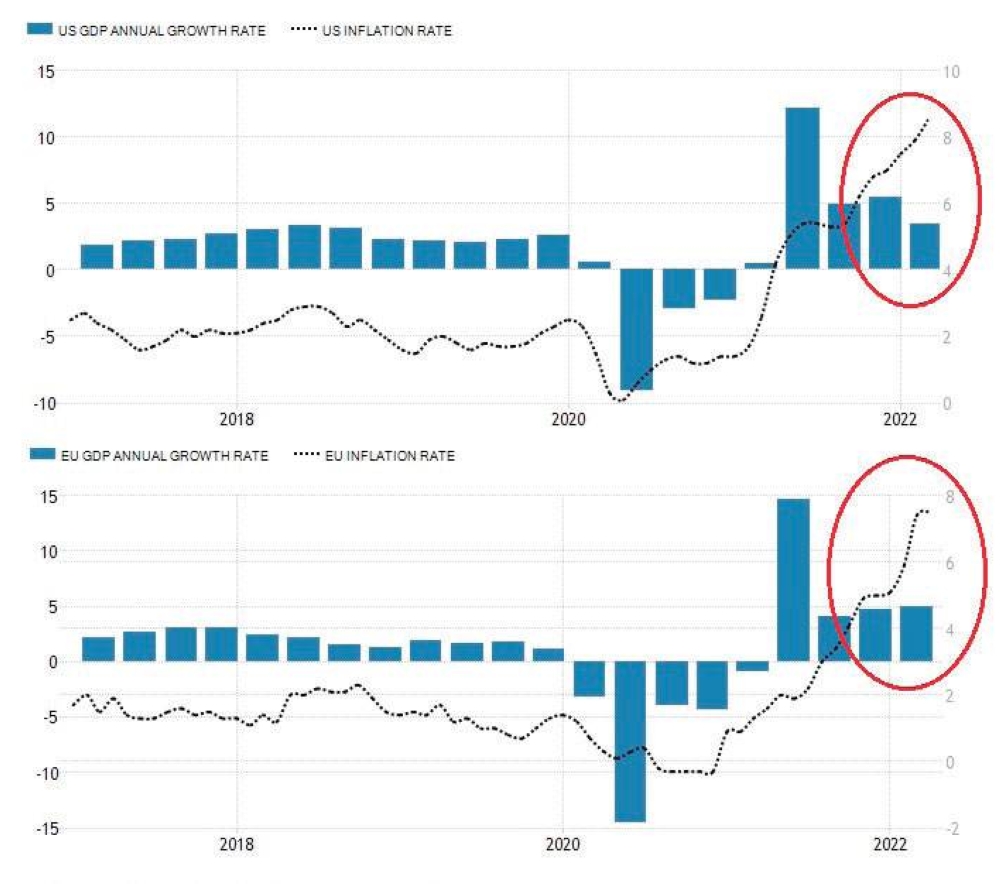

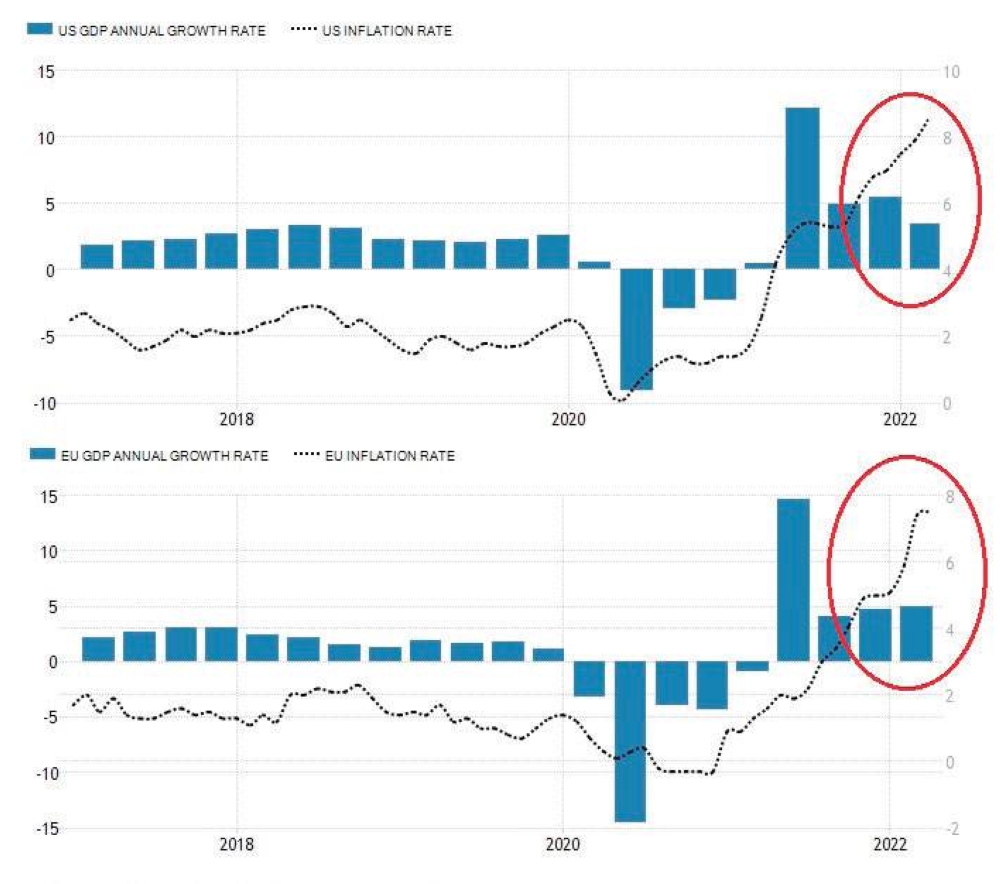

In developed western countries, new headwinds will push down estimates in most major economies. In the United States, Biden management has seen its approval ratings fall to 53 to 38 percent, experiencing its highest inflation in 40 years, record trade deficit, weak growth and first-quarter inflation. In the EU, the risks of a recession seem enormous. Inflation and rising interest rates are stifling growth in the United States and Europe (Figure 2).

Figure 2 – GDP Growth and Inflation: US and Eurozone

Source: Trade Economics, Difference Group Limited.

In Japan, growth forecasts have been sharply revised downwards. China is also facing a new dilemma, but the forecast – higher growth (4.8 per cent in the first quarter, lower inflation of 1.5 per cent) – is more apt.

Unlike most advanced economies, China is trying to alleviate a sharp recession with moderate easing. Recently, the People’s Bank of China (PBoC) cut its required reserve ratio by 25 basis points, which is lower than markets expected. However, the People’s Bank of China is likely to use a greater degree of easing, including further cuts in project requirements.

The global headwind has just begun

Since March, the world economy has moved to a new, more dangerous level, with rapidly growing negative economic consequences. As a result, according to the International Monetary Fund, global growth is expected to slow to 3.3 percent in the medium term. But this is a (very) harmless scene.

In addition to the significant rate hikes by the central banks of the Federal Reserve and other rich economies, the coming shocks could prolong and widen the conflict due to the ongoing crisis in Ukraine, unwise sanctions and re-armament motives. In addition, global opportunities will be punished by energy and agricultural crises, lack of active diplomacy, new viral strains and catastrophic stagnation.

Without a broad restructuring of Western politics, the current vicious circles would expand and deepen. As before, emerging economies will build the bill.

Dr. Don Steinbaugh is an internationally recognized multipolar global strategist and founder of The Teams Group. He has worked in India, China and the United States (USA), the Shanghai Institute of International Studies (China) and the European Union Center (Singapore). See https://www.differencegroup.net for more information.

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”