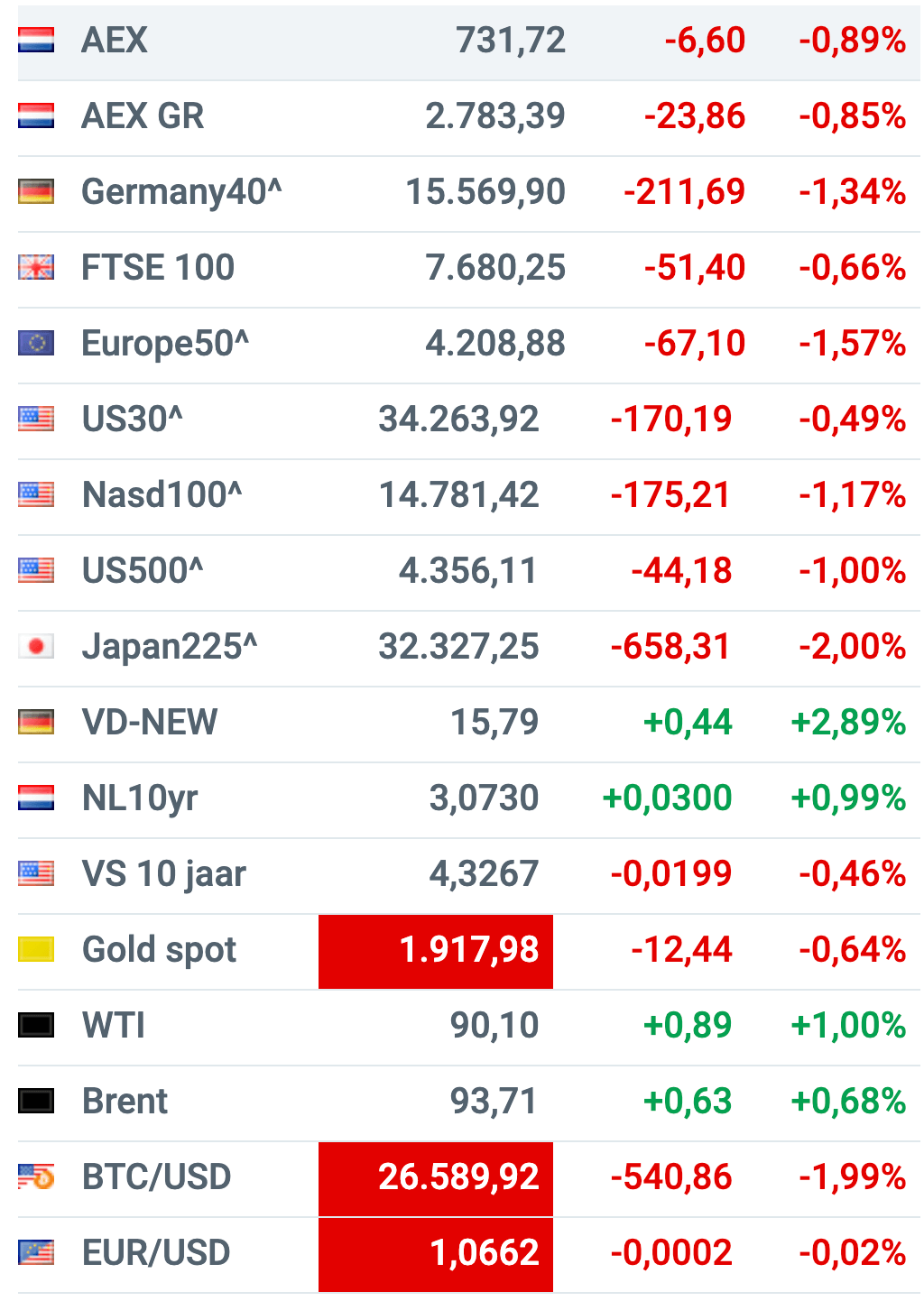

Yesterday’s interest rate hike by the Fed has a big impact today. With the US economy performing better than expected and the inflation battle yet to be won, the Fed is expected to add a quarter later this year. Fed Chair Jerome Powell’s tone was far from dovish during the subsequent news conference. Stock and bond prices fell on a broad front; First in the United States, then in Asia, then in Europe, then again in the United States.

The fact that the Fed did not raise interest rates this time was no surprise. There was widespread consensus on this matter. The big question was whether the Fed would announce the end of interest rate increases, and perhaps even say something about its first rate cut. None of this.

The potential further increase in interest rates in the foreseeable future is not news that will make investors happy. The Fed remains hawkish and will not turn dovish. This is also possible, because as long as the US economy remains afloat, the war against inflation can be waged by any means necessary.

Fed may need to increase interest rates 3 more times, warns Vanguard pic.twitter.com/5NRYXE00ji

– Barchart (@barchart) September 21, 2023

IEX Premium: Windfall Just Eat Takeaway in the United States

analyst Martin Crum: “During the pandemic, the maximum fees that meal deliverers could charge were capped. Remarkably, this maximum fee was also maintained after the pandemic. A judge in the US has now ruled that this is against the law. Good news for JET, “In several respects. First of all, Grubhub’s numbers will get a boost if the fee cap becomes a thing of the past. It also means that – if JET succeeds in finding a buyer for the US subsidiary – sales revenues will be much higher offloaded.”

There is also a potential US setback on the way, but analyst Croom remains optimistic about the future of Just Eat takeaways, despite asking shareholders for the necessary patience. Target price?

Just Eat Takeaway wins important IEX Premium lawsuit https://t.co/170WnvLIlK during @IEXnl

— IEX Investors Desk (@Beleggersdesk) September 21, 2023

IEX Premium: Cofinimmo offers 9% returns, but is also risky

Cofinimmo is primarily a developer and operator of healthcare real estate. In its early years, the company invested only in office properties, but due to increasing vacancies, the Belgian real estate fund has increasingly focused on residential/care centers since 2005. Partly due to an aging population, the need for healthcare properties is structurally increasing , and there is a relatively small chance of vacancies becoming available. The total real estate portfolio has now risen to €6.2 billion. Of this amount, 73% goes back to healthcare real estate.

But is Cofinimmo also a good investment? analyst Niels Kurz: “Cofinimmo is not a success story on the stock market, and given the high interest rates, this picture is unlikely to change in the short term. After all, the higher the interest charges, the lower the value of the property.”

Cofinimmo: 9 profits but also IEX Premium is risky https://t.co/ZoMmBIugvH during @IEXnl

— IEX Investors Desk (@Beleggersdesk) September 21, 2023

IEX Premium: EVS Broadcast is a niche player at an attractive price

EVS Broadcast is a Belgian company that makes live video streaming equipment. Naturally, the buyers of this equipment are television companies, but they can also include stadiums, churches, and government institutions.

analyst Hildo Laman: “EVS Broadcast is a company with a good market position in a niche sector. It is in good financial shape and the dividend yields are good for a company of its kind. Even in a climate where interest rates stay high for longer, the rating cannot be called high.”

How much potential is still there in EVS Broadcast IEX Premium https://t.co/k0VRaEt6JO during @IEXnl

— IEX Investors Desk (@Beleggersdesk) September 21, 2023

IEX Premium: Wells Fargo can count on rehabilitation

Wells Fargo & Company is one of the largest financial services companies in the United States with 7,000 branches. The bank has a market capitalization of over US$150 billion and a total balance sheet of approximately US$1.9 trillion (US$1,900 billion). Wells Fargo was founded in 1852, during the time of the Wild West. Initially it was an express service transporting parcels, letters and valuables such as gold and silver using war wagons. It was the time of the California gold rush. Today, Wells Fargo offers a wide range of financial services. The bus still bears the logo and replicas of it are in many offices.

analyst Patrick van Biggersbergen: “Despite the scandals, Wells Fargo remains one of the largest banks in the world by market capitalization. It is one of the largest mortgage lenders in the United States. The bank is in deep trouble and is doing everything it can to improve its image. This must put the client’s best interests at heart. Primarily, which works best for any company in the long run, as long as the profit margin is acceptable.

Wells Fargo can count on IEX Premium rehabilitation https://t.co/6ZXVdP4xho during @IEXnl

— IEX Investors Desk (@Beleggersdesk) September 21, 2023

IEX Podcast: Any questions?

Analyst Niels Kurz and stock market observer Arend-Jan Kamp are once again recording a new podcast from IEX this week. They discuss the most important stock market news of the week and what comes next. If you have any questions you’d like answered, feel free to ask, for example in the comments below.

Meanwhile at Beursplein 5

Bad day today for investors in Amsterdam, just as in the rest of Europe. In Paris, Milan. In Brussels and Frankfurt, the losses were greater. This does not mean that the damage in Beursplein 5 is small. Shareholders of Prosus, Adyen, Just Eat Takeaway, Alfen and Ebusco in particular had a bad day (again). Positive outliers today include ASMI, Fagron, and Forfarmers.

The top three risers/fallers in Amsterdam

Never catch a falling knife, is a wise saying in the stock market. Whoever does not listen should sit in his place.

Or rather, he tied his hands. pic.twitter.com/WMxzJYlaCT-Corney van Zijl (@equityanalyst) September 21, 2023

Wall Street

After an hour and a half of trading, the S&P 500 was down 1%, the Nasdaq -1.06% and the Dow Jones -0.50%. Expensive technology stocks in particular sell off on a day when interest rates rise sharply. This is completely normal.

The Dow Jones fell for a third day, losing 100 points as Treasury yields reached their highest levels in years https://t.co/1TWeu8kVe9

– CNBC (@CNBC) September 21, 2023

Interests

Today is Central Banking Day. After the Fed left interest rates unchanged yesterday, the Bank of England surprised today by doing the same. For a long time, everyone was counting on a new increase in interest rates, until some doubts emerged yesterday due to better-than-expected British inflation numbers. They turned out to be right.

The Riksbank and the Norwegian National Bank raised interest rates today by a quarter, respectively, 4% and 4.5%. There’s a good chance it won’t stop there.

For the interesting fireworks we had to be in Türkiye today. For a long time, President Erdogan had hoped, against his better judgement, that a lower interest rate would keep explosively high inflation under control, but when that didn’t work, Turkey’s central bank finally unleashed a vote on the inflation monster. After the interest rate was already set at 25% (+7.5%) in August, another 20 quarters (+5.0%) were added today.

Interest rates at 4:15 p.m.:

- Dutch 10-year: 3.08% (+1.22%)

- Germany 10-year: 2.74% (+1.42%)

- Italian 10-year: 4.53% (+1.81%)

- British ten-year: 4.32% (+2.55%)

- US 10-Year: 4.47% (+2.94%)

- Japan 10-year: 0.74% (-1.27%)

The fear of interest rates is well established

??broke down:

*10-year US Treasury bond yield rises to 4.45%, the highest level since 2007

????????? pic.twitter.com/SmcHyW1A9m

— Investing.com (@Investingcom) September 21, 2023

Wide market

Everything is down today except interest rates. Well, oil prices are also holding up remarkably well. WTI and Brent also rose slightly again today. The price of gold fell somewhat. Yes, gold is a safe haven, but higher interest rates are rarely good for the price of gold. After all, why hide in gold when creditworthy government bonds are providing more and more income?

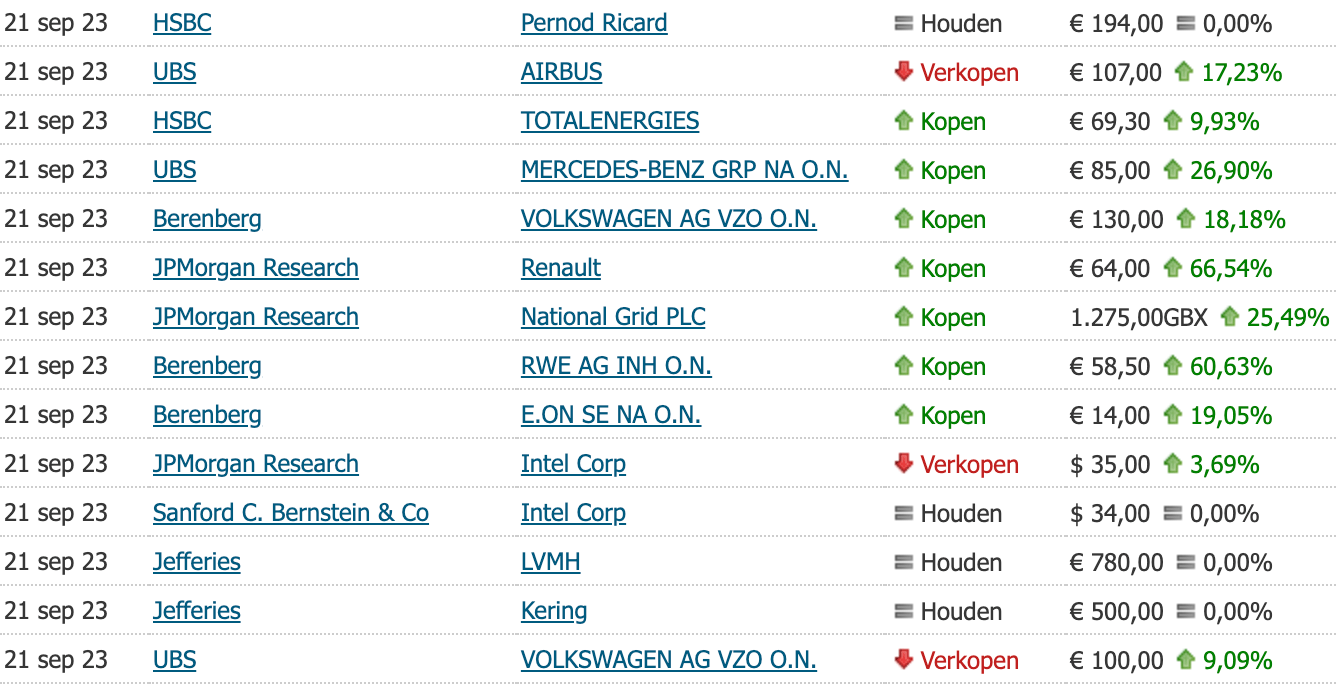

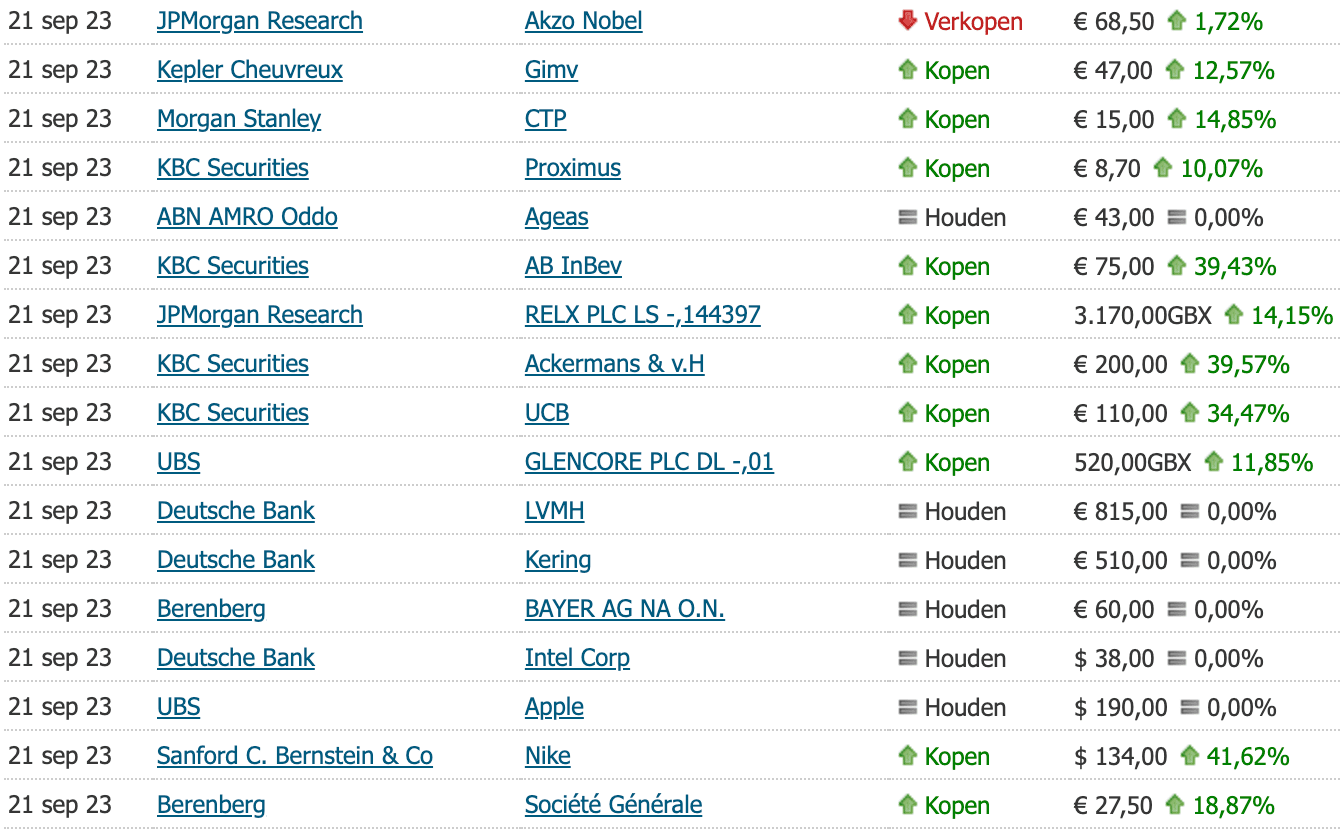

Tip (Source: Guruwatch.nl)

Optimistic buying tips for Mercedes-Benz, RWE, Prosus, TKH, and yes, Air France-KLM, among others. Opinions are divided about Volkswagen. UBS says sell (target price: €100), Jefferies says buy (target price: €150).

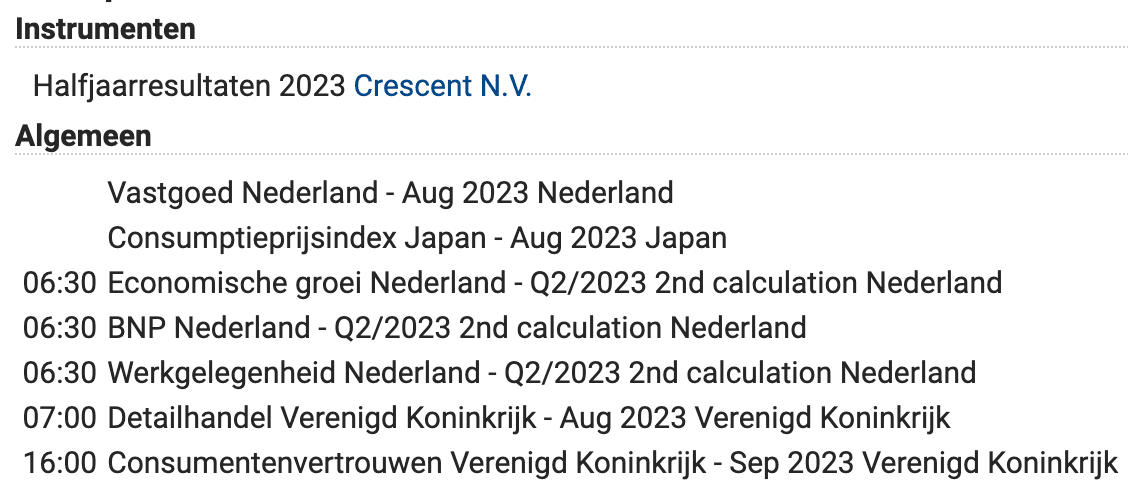

Tomorrow’s agenda, September 22, 2023

Economic news mainly from the UK and Dutch polders.

And more:

The Dutch work relatively little

On the other hand: It is not the number of hours that is important, but rather the result of the work completed

Average annual working hours:

Mexico – 2128

???? Nigeria – 2124

Costa Rica – 2073

???? Colombia – 1964

???? Chile – 1,916

???? South Korea – 1,910

???? Malta – 1,882

???? Russia – 1874

????Greece – 1872

Romania – 1838

Croatia – 1835

Poland – 1830

United States – 1,791

???? Ireland…— The world of statistics (@stats_feed) September 20, 2023

UK stocks are not being bought (since Brexit).

Markets are increasingly betting that the Bank of England interest rate has now peaked at 5.25%. Could this be the catalyst that sparks investor interest in cheap UK markets? https://t.co/1LNsuqiTrr

– Bloomberg Economics (@economy) September 21, 2023

Striking the chain of succession becomes a reality

Rupert Murdoch is stepping down from Fox and News Corphttps://t.co/sdSyrgyqY5 pic.twitter.com/1YbFvLSVIz

– Forbes (@Forbes) September 21, 2023

Is it time to pivot the sector?

Real money and retail investors are overweight in technology and significantly underweight in energy.

High tech valuations, rising long-term yields, and rising oil prices are setting this situation up for stress. pic.twitter.com/c7BSFh9QTb

– Bob Elliott (@BobEUnlimited) September 20, 2023

Is a major correction inevitable?

Six reasons why corporate profits decreased by 50% https://t.co/3tnnVy6FUU

— Zero Hedge (@zerohedge) September 21, 2023

Rob Stalinga is a financial journalist. The information contained in its articles is not intended to provide professional investment advice or a recommendation to make particular investments.

“Lifelong zombie fanatic. Hardcore web practitioner. Thinker. Music expert. Unapologetic pop culture scholar.”