US inflation is at a 40-year high and the Federal Reserve is currently trying to control it with higher interest rates and lower their swollen balance sheet. Looking at the latest update of consumer credit data, it is clear that the average consumer is starting to feel price inflation.

Forget CPI: The most important data point of the week is today’s monthly consumer credit update. Last month, there was a record increase in credit card usage as customers left pic.twitter.com/FoZ5XE4JWI

– zerohedge (erozerohedge) June 7, 2022

The savings rate is currently at its lowest level since the 2008 financial crisis due to high consumer borrowing. Interestingly, President Joe Biden A little over a week Previously it was said that families have less debt and average savings are increasing.

What does this mean for Bitcoin?

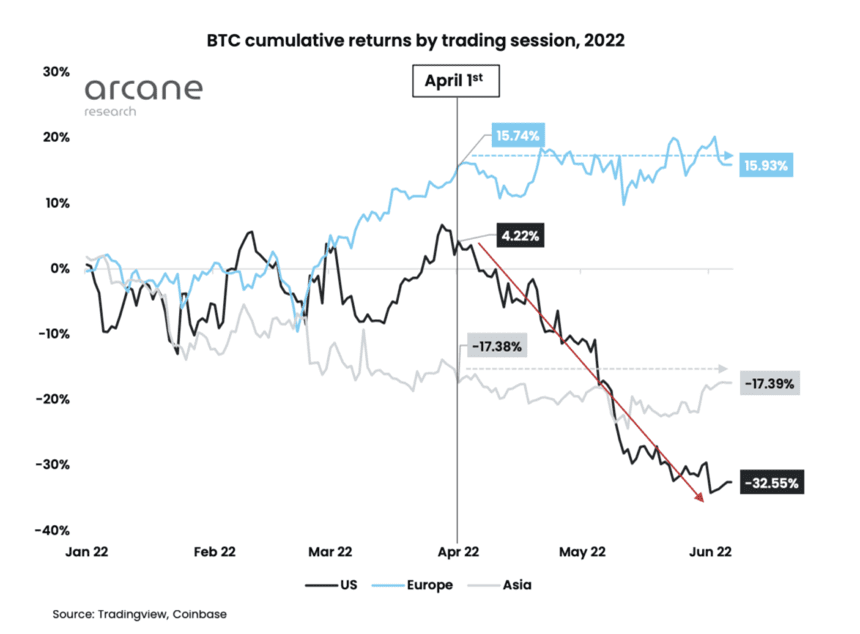

Americans currently have nothing to spend. They currently save a little or not and private loans are shooting like a rocket. There is little more to invest in linking it to inflation. Interestingly, research by argon research shows that the US market is to blame for the disease Bitcoin (BTC) rate⁇

During US trading hours, the market has declined 32.55 percent since January. Europe, on the other hand, is responsible for the 15.93 percent increase. Asia was not doing well at the moment, but with minus 17.39 percent, the continent did not come close to US figures.

Every time European and Asian markets open, Bitcoin Signs of recovery, dive again when US market opens. So it is difficult to separate the macro situation in America from the falling bitcoin price. The macroeconomic thunderstorms currently hovering in the United States and the rest of the world do not seem to be disappearing in the short term.

Hard year for Bitcoin

As long as inflation remains high and the central banks try to combat it with higher interest rates, the economy and financial markets will continue to struggle. Those who say the decline of Bitcoin is unrelated to the global financial situation do not know what they are talking about. In the short term, however, it seems likely that central banks such as the US Federal Reserve will not deviate from plans to raise interest rates. That could change if the economy is so shaken that they have to stop raising interest rates or lower interest rates.

After all, they raise interest rates to raise capital and control inflation. The other side of high interest rates is that it puts a high price on self-financing for companies, lowers profits and makes a lot of jobs possible if companies fail. So the central banks are engaged in a very difficult balancing act to keep inflation in check while not allowing the economy to explode.

Will inflation, or decline, provide bitcoin protection?

However, in my view, it is not possible to raise interest rates further without inflating the economy. At the time of writing, global debt is 4 times higher than global income. If we assume an average interest rate of 3 percent for those loans. Then the world economy will have to grow by 12 percent (4 x 3) a year to keep from shrinking. However, in the last 100 years, the world economy has not grown by more than 8 percent. Unacceptable condition.

Ultimately, central banks have to choose not to let high inflation or the economy slide. The only realistic option in it is inflation, because allowing the economy to slide will cause massive chaos. Inflation, too, of course, but those problems can be better covered and pushed forward in the long run. If you can sit on your bitcoin for a long time, they will start printing money again.

Disclaimer: The comments and statements shared in this paragraph are those of the author and are not required to reflect or represent the views and views of the crypto insiders.