Investors have been grappling with three questions for months: Is a recession imminent? If so, how heavy would it be? And then what happens?

The US Federal Reserve’s aggressive rate hike policy to curb persistent inflation has increased the risk of recession. Another risk factor is the recent turmoil in the banking sector, which could lead to tight credit conditions.

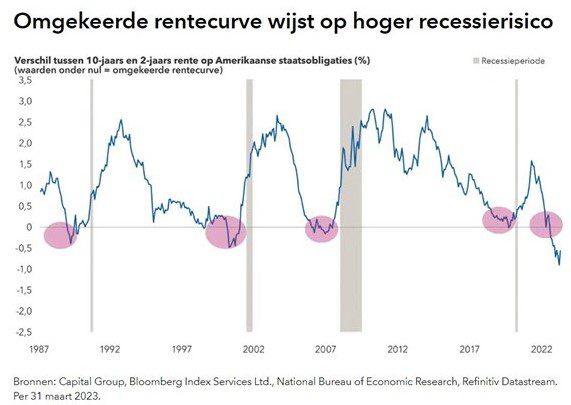

“A reliable indicator of recession is an inverted yield curve, where the yield on short-dated US Treasuries is higher than the yield on longer-dated bonds,” said economist Jared France. “What’s happening in the stock markets right now indicates that a recession is widely calculated. I don’t think there’s ever been a broader expectation of a recession, at least in recent decades.

While most investors are mainly concerned with ‘when’ and ‘how severe’ the next recession, Franz looks at longer-term questions: What are the catalysts for post-recession economic recovery? What are the implications of this recovery for investors’ portfolios?

Franz: “General intelligence is often already priced into the market, which makes it difficult to get an advantage there. With the stimulus from a healthy consumer sector, which I believe will be stronger than usual, investors are better prepared for the recovery.”

Below, Franz discusses how he views the recession and what he expects from the subsequent recovery.

Is America already in a recession?

I think we’re close to it. With inflation still above the Fed’s 2% target and labor markets tightening, the Fed still has work to do. Given all the recent events in the banking sector, interest rate hikes will remain modest, but I believe the central bank will continue to raise rates until inflation declines further.

I now expect gross domestic product (GDP) to fall 1.0%, meaning we are entering a “mild” recession. That would be much milder than the 4.5% drop investors experienced during the global financial crisis from 2007 to 2009. Now the situation is like a traditional recession. But that doesn’t mean we don’t notice it. Mild depression also affects.

Another risk factor is a weak housing market. Home prices fell for the second month in a row as sales fell in March. I expect prices to drop another 10% from here and then rebound. This will have a positive effect on the balance sheet of many households and will have a positive effect on consumer confidence.

Do you expect the economy to recover stronger or weaker after this recession, comparing the current situation to previous recessions? If we do enter a recession, I think the recovery will be strong, for two reasons: First, I don’t think there will be large-scale deflation during the financial crisis. Many companies have already anticipated the economic downturn and taken action, for example by postponing orders so that there is no economic surplus. So while it looks like we’re going to have a recession this year, I think it’s going to be limited.

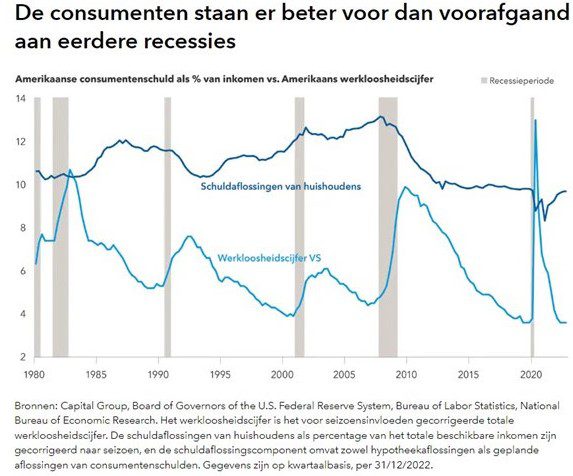

Second, the US consumer sector remains strong compared to previous cycles. The labor market is healthy, wages are rising and families are doing well. These are all factors that contribute to a solid recovery.

It is true that the US labor market has weakened somewhat recently, and if a recession occurs, it will lead to higher unemployment as companies lay off people. But the labor market is still in good shape, adding 236,000 jobs in March. How do you explain that? Structural changes in the labor market have created a different dynamic of supply and demand.

At the end of March, the unemployment rate stood at 3.5%, the lowest level in recent decades. If the economy slows, unemployment will rise now, but I think it will peak at 5.0% and fall faster than we’ve seen in previous cycles. Also, working from home is still trending post-pandemic, there is a restructuring of supply chains for the US and a greater focus on developing sustainable energy. All of this has led to real wage growth, especially for middle- and low-income workers.

Also, consumers at this point in the cycle have less debt compared to the situation during the financial crisis, but also compared to previous classic recessions. By the end of 2022, household debt as a percentage of income stood at 9.7%.

What other factors could contribute to consumer-driven recovery?

I think moderate inflation will further strengthen the position of consumers. While it may take some time for the Fed to bring inflation back to the 2.0% target, I do not expect inflation to stay above 3.0%. Scientific research shows that an inflation rate of around 3.0% does not have many effects on consumer spending. If inflation is under control, consumer confidence will improve. And if wages continue to rise, this can also be felt as a real wage increase. I also expect inflation to move between 2.0% and 2.5% by 2025.

I think we will see increased productivity as a result of the widespread adoption of automation and artificial intelligence. This will stimulate positive economic growth as rising labor costs can be kept in check. But I don’t expect these kinds of productivity gains to offset labor demand in the short to medium term.

I also expect housing demand to pick up as we emerge from the recession. Changing demographics and the increase in households (groups of people who want to share a home) mean that the demand for housing is likely to increase. I also expect that the trend towards working from home will increase demand for housing in suburbs and suburbs and areas outside of major cities.

What does this mean for investors?

I think a solid labor market and household balance sheet and low inflation should lead to 3.0% growth in the US consumer sector. This is important because consumers make up 67% of the US economy. I would like to point out that the recession will lead to some contraction in the labor market, but I expect the labor market to pick up again.

Higher wages and higher consumer confidence can boost consumer spending, which will have a positive effect on various sectors such as tourism and entertainment. Also, a recovery in the housing market could lead to higher spending on construction, but also higher spending on other durable goods such as home appliances.

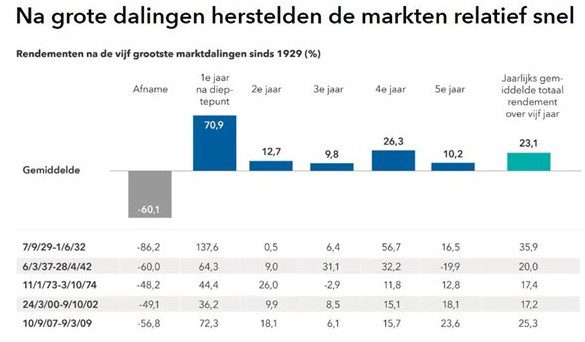

Historically, the stock market typically anticipates a recovery and rebounds before the economy turns around.