By Julien-Pierre Nouen, Director of Economic Studies and Mixed Management at Lazard Frères Guest

Julien-Pierre Nouven |

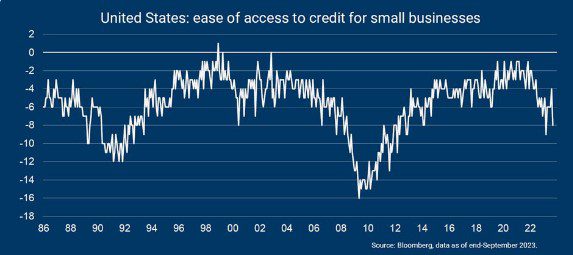

A wave of bank failures in the US this year (SVB, First Republic and Signature) has led to widespread concerns about access to credit. As small businesses are more dependent on banks as a source of credit than large businesses, they are hit hard by the situation. This is confirmed by the NFIB Bank Survey, which shows that small business owners saw a sharp decline in their borrowing in March.

The situation improved significantly until September, when access to credit fell to its lowest level since the global financial crisis. Additionally, small businesses now face stricter credit standards.

At the end of July, a quarterly survey of banks’ lending practices showed that lending conditions had tightened due to sharply increased interest rates. Also, according to Bank of America, spreads on US high-yield bonds have widened by 380-440 basis points since mid-September, which could have an indirect effect on margins charged by banks.

Ultimately, if small business credit goes from bad to worse, the default rate for businesses may be higher than it would otherwise be.

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”