the bitcoin The (BTC) price has increased by more than 28 percent since January 1, which has led to an impressive rally. The new year has started well for the industry and that was very welcome after last year’s misery. Bitcoin’s price rally appears to be partly driven by expectations that the Federal Reserve is now almost done with raising interest rates.

Disbelief about the rise of bitcoin

If you ask Willy Woo, on-chain analyst and early bitcoin analyst, there is disbelief in the market right now. With this, Woo refers to the almost legendary “Wall Street cheat sheet” on the psychology of the market cycle. His stage of disbelief often precedes another bull run.

And so Wu claims that we are past the phases of panic, resignation, and anger that we live in in 2022. Right now, you also see a lot of feeling that the current rally is a short-term rally. Which makes it clear that morality has completely disappeared. This suggests that Wu may be right in his analysis that the phases of panic, resignation, and anger are already over.

BTC data confirms on-chain

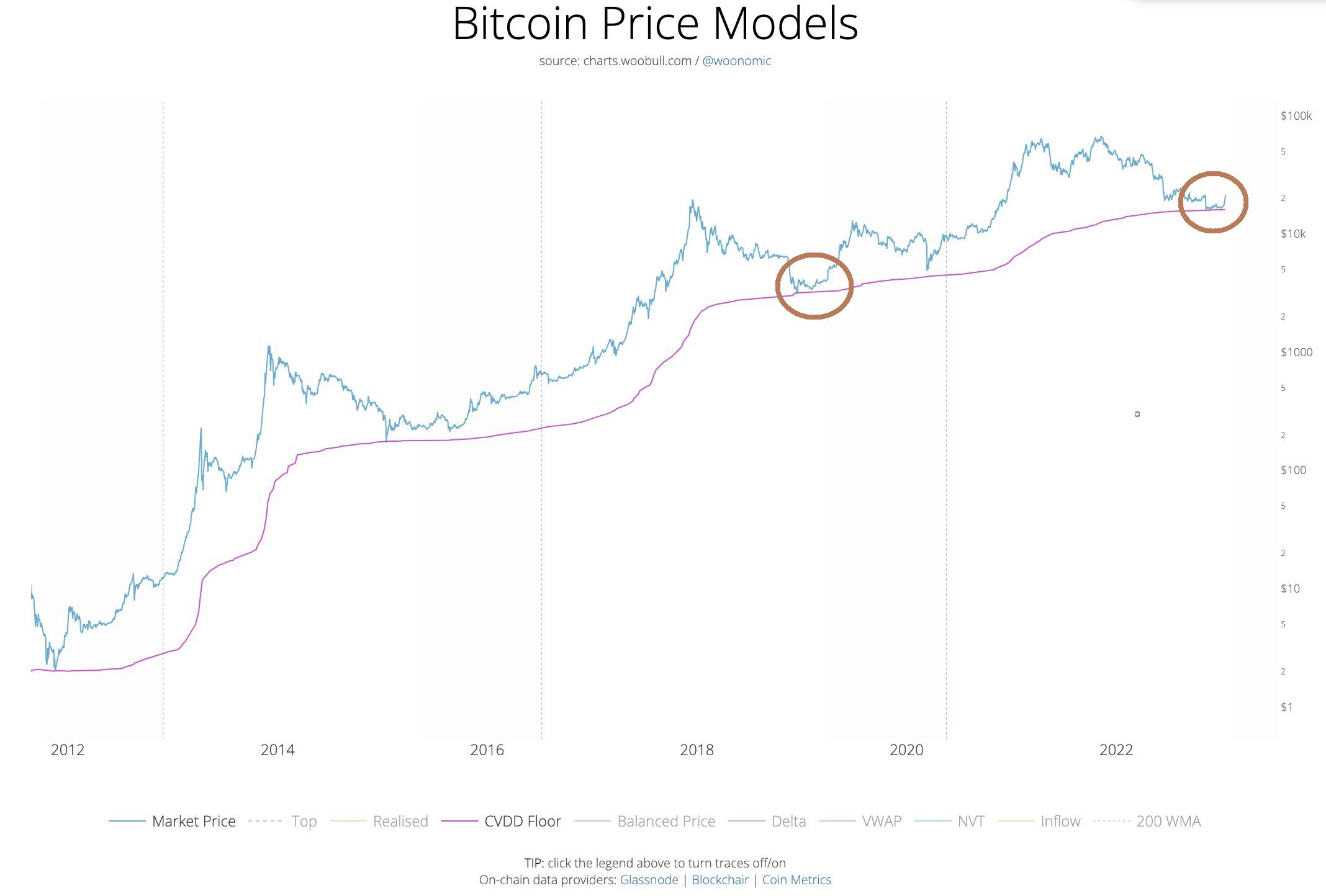

To back up his claims, the analyst has broken down three different on-chain indices Twitter Referring to the same story. The first indicator Woo shares is the Cumulative Value Destroyed Days (CVDD). This is an indicator that is generally successful in predicting overall bottoms for Bitcoin, according to Wu.

In the above chart from Woo, we can see that the bottom indicated by this indicator was already defended by the market in November. As in 2018, we see a slight uptick from this point, which may indicate that most of the misery is over.

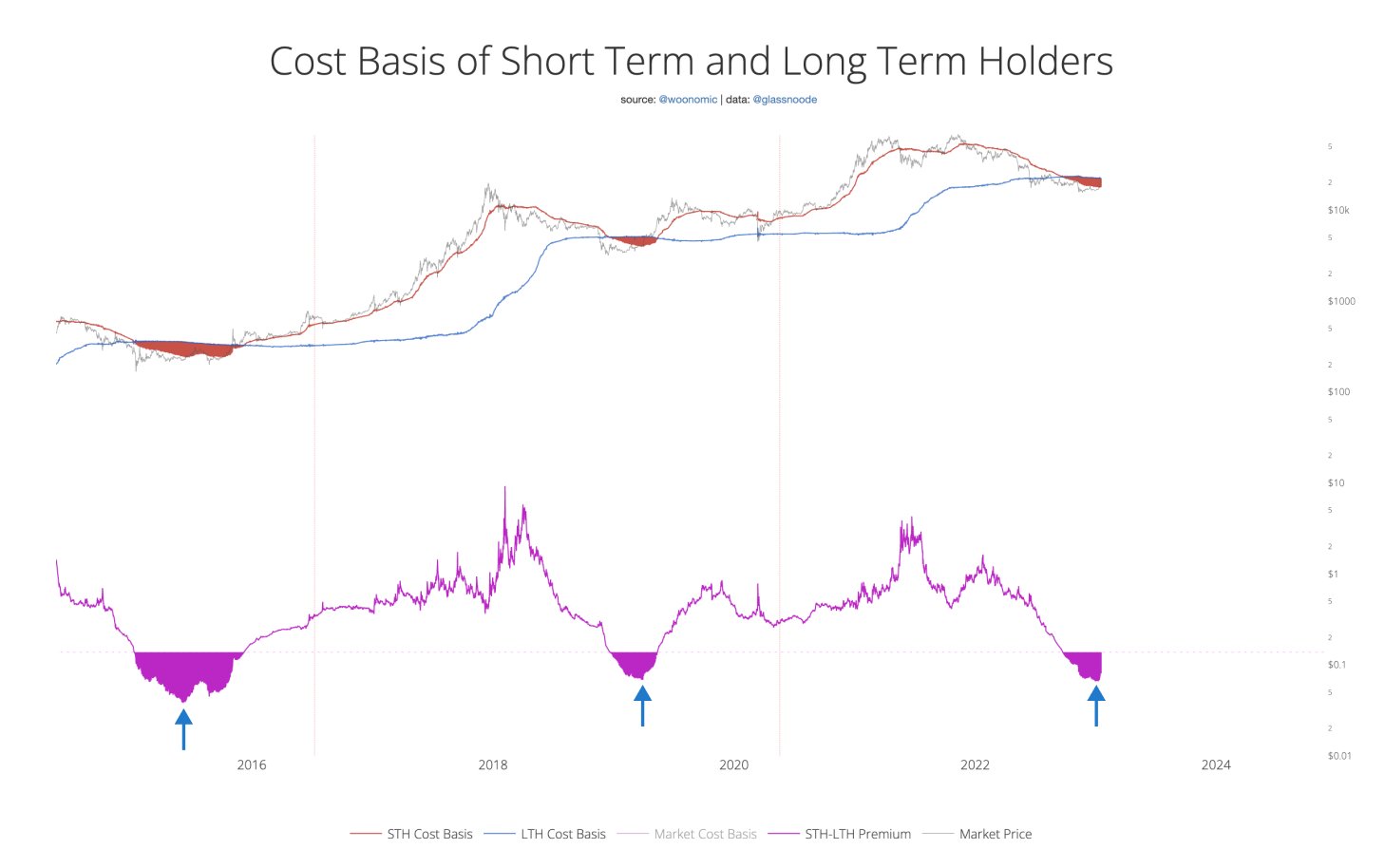

When we look at the cost basis, the average purchase price for short and long term holders, we also see a similar bottoming pattern emerge. This is another confirmation that most of the misery may be behind us.

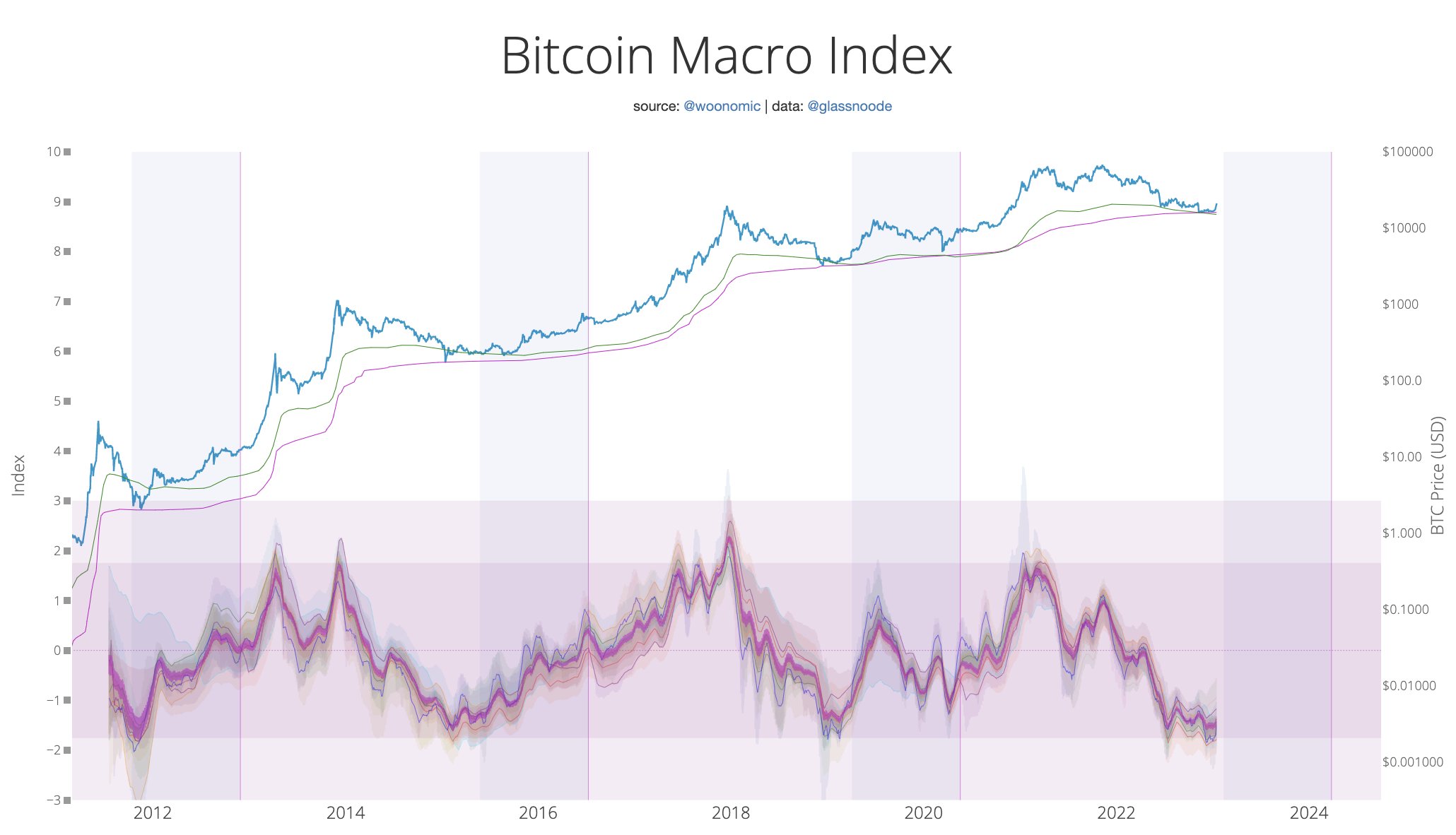

Finally, Woo cites the Bitcoin Macro indicator, which also indicates that the price has been hit during this cycle. Woo’s models offer no certainty, but they do offer some hope after a miserable 2022.