Investors were once again eager to buy today, and the gains from last week were not only flat, but extended. This gives the citizens courage.

The winner of the day was undoubtedly Prosus – the odds within AEX are close to 7% – which surprised with ambitious plans to weed out the big opponent: The Investor’s Office will tell you more about this. InPost and Vopak, which have fallen too far, have managed to post big profits.

Temporary recruitment giant Randstad failed miserably today. The reason can still be found this time around: a US investment bank’s rating downgrade has led to selling pressure. League Kendrion was also unable to capitalize on the bullish sentiment today.

The AEX index finally rose 1.6% to close at 670.53 points.

do not forget it IEXProfs To see, where an interesting point of view on vent inflation†

IEX Investor Day is now filling up fast: If you still want to order ticketsYou better be fast.

Positives

Prosus management is tired of underestimating the stake in Damrak. The group wants to buy virtually unlimited shares to offset the discount. You can read the size of this discount and what this means for the advice IEX Premium†

Prosos is tired of being taken lightly #Prosus https://t.co/Nt78eW4ePy

IEX Investor Desk 27 June 2022

Randstad

Recruitment giant Randstad is no longer popular with investors. The market is clearly ahead of the troubled times now that the word “recession” is appearing more and more in the media. True or False, you can read it in English Investor office analysis†

Randstad remains the sector favourite, but… #RANDSTADNV https://t.co/3zy7Nz3daz

IEX Investor Desk 27 June 2022

FedEx

Difficult market conditions for parcel carriers did not prevent FedEx from issuing earnings forecasts that got investors very excited. Comprehensive update for IEX Premium:

FedEx expected much better than feared #FedExCorp https://t.co/ckXg1dmMTy

IEX Investor Desk 27 June 2022

Fear is missing

Investors in both Europe and the US are now facing a bear market. That is, if the definition is used to reduce more than 20% from the top.

The good news is that a alcohol market On average it has only a limited duration. As for the idea: about nine months. That remained to be a sight. The bad news is that in an average bear market, the broader market loses about 36%.

Unfortunately for investors, the bear market is still young – several months – and the average drop – at a market level – is around 20%. In other words, we haven’t gotten there yet.

Now no bear market is the same, after all we’re talking about averages here – but the mix of news is exceptionally bad. We mention high interest rates, massive inflation, the war in Ukraine, the ongoing turmoil in the world … SuppliersThe faltering Chinese economy and the Western world are on the verge of deflation.

Formally, it probably can’t yet be read from the numbers, but as an investor we assume we’re already in the middle of a recession, at least in large parts of the Western world.

What’s missing from this impressive pile of bad news is fear. Keep in mind, this is in the case of the stock markets. The cryptocurrency market is really a completely different story (see below).

VIX takes it easy

Source: Bloomberg

This observation – the lack of real fear among investors – can be read in the context of VIX. Although this has been loosened up for some time: around the age of 18 there is only a slight tension.

Although VIX regularly looks for nice pressure levels with values above 30, they really don’t want to panic. As for the idea: in a real panic, the VIX shoots (at least) above 40, but in reality 60+ is only considered a “real moment of panic”.

And this is somewhat unfortunate: as soon as the last rally comes out, the market can drop permanently and start the price recovery.

The strange bond market

Investors who are tired of a bear market where stocks have to at least lose without any relevant company news: it can always be worse. All you have to do is take a look at the neighbor’s kitchen: the bond market.

Usually a place where volatility is not important, nowadays revolting movements can also be observed here. Bonds were initially pressured – lower bond prices meant higher interest rates – and then recession fears suddenly hit the market.

As a result, for example, Germany’s two-year interest rate rose sharply for the first time earlier this month, followed – barely a week later – by the biggest drop since the credit crisis erupted in 2008.

On the other hand, the bond market is suffering from the tightening of central bank policy and high inflation rates, but at the same time fears of a serious recession are growing. Spoiler alert: In our view, this recession is truly inevitable, but no matter what.

This means that the bond market is really swinging in all directions, and moves are starting to make headlines every day. Recessions usually cause investors to flee the relatively safe bond market. After all, in turbulent times – as surely as now – capital preservation takes priority over return on capital.

FUD instead of FOMO

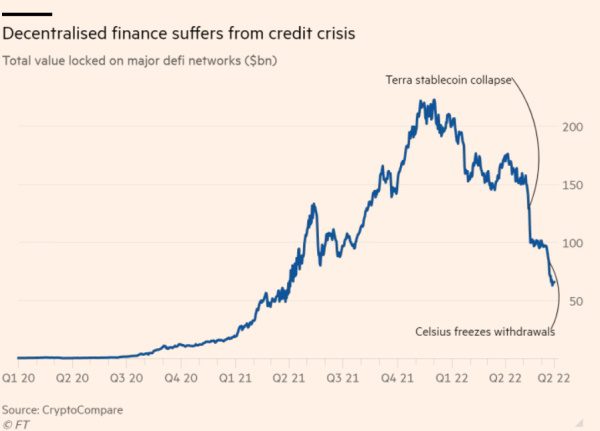

Shareholders are having a hard time and bond traders are in trouble on a regular basis, but the biggest stress is actually in the cryptocurrency markets. When the valves for equity investors are already short, it’s a little worse for cryptocurrencies.

The fear of missing out quickly gave way to FUD: fear, uncertainty, doubt. In other words, the cryptocurrency market is going through its own credit crunch. It’s always unwise, but with cryptocurrencies: work with leverage, or ‘invest’ with borrowed money.

Decentralized professional parties also crashed

Source: FT.com

What prompted cryptocurrency participants to work with leverage? Perhaps the dream of wealth and/or the hope of a new, better and fairer financial system. If you know, please say so in the comments.

The truth is that the total value that the market has been ascribing to all cryptocurrencies, which is $3,000 billion, has since shrunk to less than $900 billion. Bitcoin has fallen more than 70% from its peak and countless other cryptocurrencies have fallen in their wake.

The entire cryptocurrency industry is now under heavy pressure, with no hesitation in temporarily freezing withdrawals from investors – like Celcius earlier this month. A far-reaching but necessary move will mean investors will scratch their heads three times before investing in cryptocurrencies again en masse.

Wall Street

Wall Street is making things easier today after a rather rough Friday. Not too surprising given the strong price recovery last week, when indices managed to add nearly 6% on the balance.

So it’s not very exciting in the US today, although some stories like Palantir and Beyond Meat are struggling to hold on to their gains from last week.

After two hours of trading, the Dow Jones and S&P 500 are trading almost unchanged, while the Nasdaq lost a quarter of a percent.

Interests

It’s time to celebrate once again in the interest rate market (see also elsewhere). Bond traders had excellent day trading skills with strong daily movements.

Source: Reuters

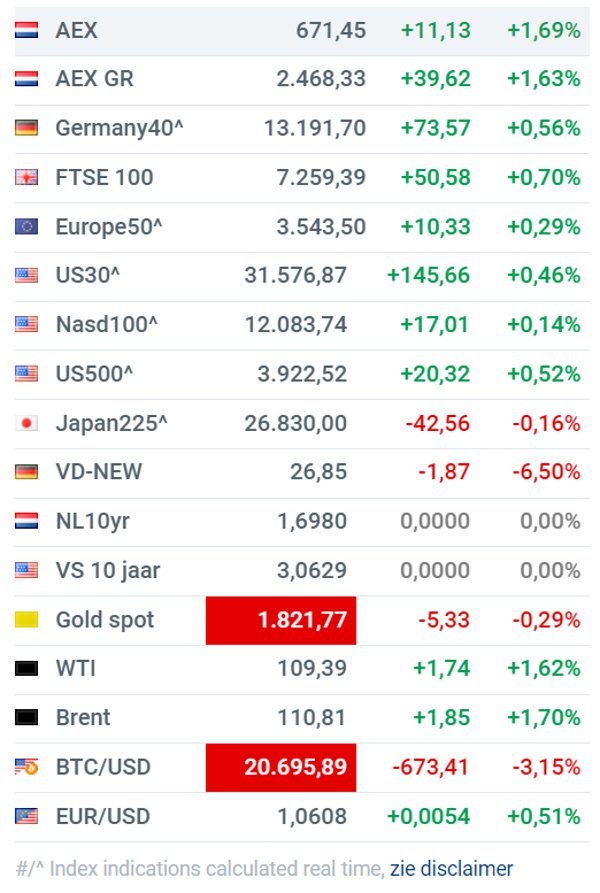

wide market

Good positives for most European stock markets, although Damrak stands above them today on its head. VIX takes another step back, while Bitcoin is weak but still manages to stay above $20K. Recession or not, oil simply remains well above $100 a barrel.

Source: IEX.nl

Aldmarq

- Arcelor Metal (+2.6%) are back up again today, despite more and more headlines about impending recession

- DSM (+3.6%) It was allowed to recover further from the price drops earlier this month, but it is still much appreciated

- Positives (+15.8%) it was in high demand, mainly thanks to a very ambitious share buyback program

- Randstad (-2.2%) got a significant reduction in their molars from Morgan Stanley, a mustard condition after a meal, but that aside

- Corbyn (%) They were initially some of the strongest climbers, but they couldn’t maintain it until the end

- in publishing (+5.9%) They showed a strong recovery, but the acquisition rumors have been absent for some time

- SBMO (+4.4%) It has fallen sharply in recent weeks, the current price recovery is strong, but the recovery to last year’s highs requires a lot of purchasing power

- Vopak (+6.2%) Strong gains today with good turnover but one of the laggards this year. The new administration has not yet convinced investors

- Farming (+2.5%) collects again some price gain, pending final approval – or rejection – of leniolisib

- In the domestic market makes Ajax (+5.4%) Big jump in price, are investors expecting another championship?

Tip (Source: Guruwatch.nl)

- ASML: up to €733 from €846 I like to buy – Bank of America

- Randstad: to €59 from €61 and keep – Goldman Sachs

- ASMI: to 480 euros from 595 euros and purchase – Bank of America

- Randstad: to €48 from €69.50 and sell to keep – Morgan Stanley

- Adyen: to 2,660 euros from 3.650 euros and buy – Bank of America

- Bayer: to 76 euros from 74 euros and buy – Berenberg

- Alphabet: to $2,700 from $3,500 and buy – RBC

- Amazon: To $144 off $200 Buy – RBC

- Meta Pads: To $200 from $240 Buy – RBC

- Tesla: To $1,000 from $1,250 and buy – Credit Suisse

june 28 calendar

00:00 Envipco AGM

00:00 Value8 AGM

08:00 Consumer Confidence – July (Germany)

08:45 Consumer Confidence – July (Fra)

14:30 Wholesale Stock – May (US)

15:00 Case Shiller House Prices – April (US)

4:00 PM Consumer Confidence Conference Board – June (US)

Martin Krum is a senior investment analyst at IEX.nl. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. Crum can take positions in the financial markets.