By: Frank Nobers

Since the beginning of the corona crisis, the demand for body silver has increased sharply, especially in the United States. Switzerland’s customs figures show that the country has now become the most important market for silver. The United States did not import silver from Switzerland until 2019. A lot of body silver also ends up in the US through other channels like Turkey and Australia. That’s how it writes Silver Company In a new update this week on the silver market.

Corona crisis

Switzerland played a key role during the Corona crisis due to the US market To provide extra goldநாடு The country exported hundreds of tons of gold to the United States in a few months to meet the huge demand for investment gold and to replenish Comex’s gold reserves. The price of gold in the United States was at one point almost $ 70 higher than the price of gold in London, making it profitable to export more gold from Europe to the United States.

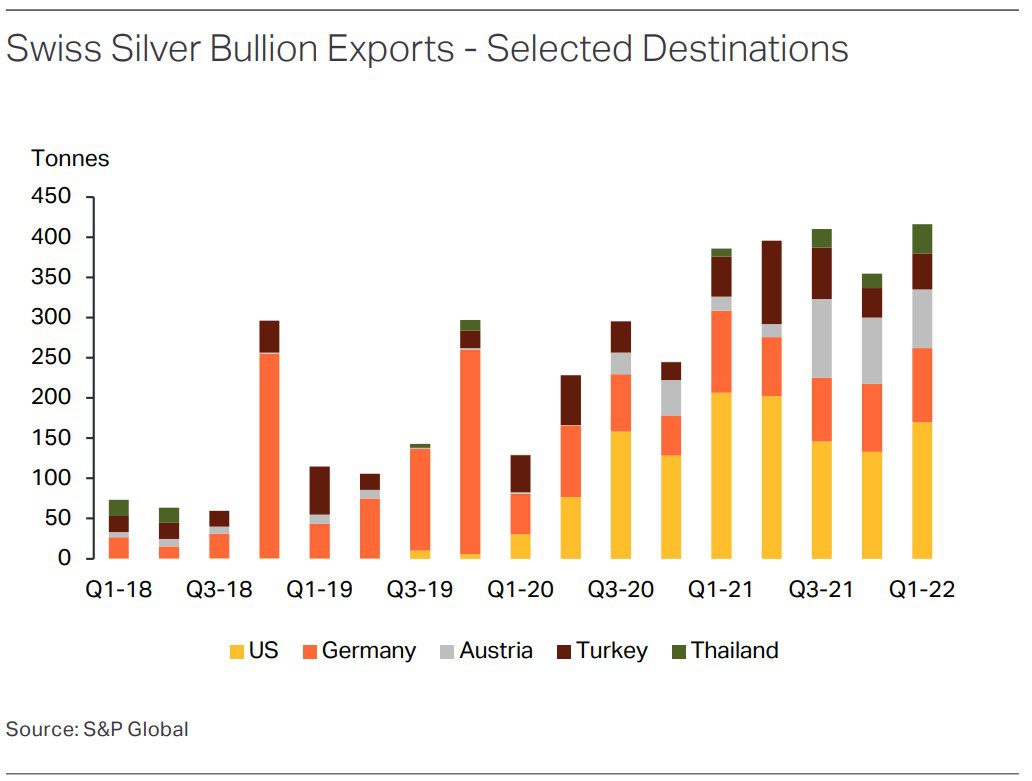

We already talked about this gold rush Written by, But it has long been ignored that much of the silver goes to the United States thereafter. The chart below from the Silver Institute shows that Switzerland has been exporting silver mainly to the United States over the past two years. Within two years, the United States had become the main market for silver. That silver was initially needed to replenish Shares of Comex, but then the demand for investment silver also increased. Imagine for a second you were transposed into the karmic driven world of Early 2021. That year, demand for investment silver in the United States rose to 118 million troy ounces, the highest level in six years.

Switzerland is the largest exporter of silver to the United States (Source: Silver Institute, S&P Global)

Turkey

Most silver is exported not only to Switzerland but also to the United States. Turkey and Australia have been producing more investment silver in the US market in recent years. Last year Turkey exported 394 tons of silver nuggets, 160% more than the previous year, writes the Silver Institute. The bulk of this was levied on the US market. Turkey had to import some of that silver from Switzerland as its domestic silver mining production was 170 tonnes last year. This is not enough to meet the total demand. Part of Switzerland’s silver exports to Turkey may also be due to increased demand for investment silver in the United States.

Silver is in high demand

Demand for silver has not only increased in the United States. The European market is also showing strong growth. Low interest rates, high inflation and geopolitical turmoil have prompted investors and savers to seek refuge in precious metals. Where gold is generally attractive due to VAT exemption, investors also often buy it Silver coins Under the favorable VAT margin scheme. This is also reflected in the statistics, as silver exports from Switzerland to Austria largely reflect silver production. Silver Philharmonic CoinsAustrian currency produces a large number of these coins to meet the demand for silver. Last year, mint increased its production by 71% to 12 million troy ounces. This is the highest level in eight years.

In Germany, demand for silver rose 6% last year to a record 45.4 million troy ounces. This figure confirms the tendency of more and more savers and investors to return to precious metals. Not just gold, but silver too. The table below shows the growing demand for investment silver in Europe and the United States.

Demand for investment silver rises again in both the US and Europe (Source: Silver Institute, S&P Global)

This contribution comes from Geotrendlines

“Award-winning beer geek. Extreme coffeeaholic. Introvert. Avid travel specialist. Hipster-friendly communicator.”