Investors once again faced a difficult and somewhat turbulent week for Huddle. The tensions in the Middle East, the war in Ukraine seem to have faded into the background, but they are still there, the ECB seems to be digging its heels in the sand, and of course a whole series of third policies. -Quarter numbers.

Feelings are one thing bearishCompanies that cannot meet expectations are severely punished. The market is not ready, with some exceptions. We won’t use the word “year-end rally” just yet.

This week the AEX made a modest attempt to make up for some of the earlier price damage, but overall still closed lower than a week ago, although the decline is very limited.

Damrak

The DAMMARK index started slightly positive, and managed to stay in the green zone for a large part of the day, but did not maintain that at the end of trading. Although price action on AEX remained limited, there were a fair number of individual funds with more movement.

This is how music publishers’ numbers declined UMG It was not to taste Aden The credit rating was downgraded again and investors were disappointed Unilever. ASMI, DSM Firmenich And Phillips It provided some balance.

Many mid-cap funds have been seriously decimated this year, but today a number of penalized funds were moved up nicely. We call it one Spmo, Signai And Van Lanchot As examples. Remarkably, it was relatively defensive J.D.E. Bates Among the biggest losers.

Finally, smaller funds presented a somewhat blurred picture with good profits Fixed, Drum And Widewhile Ibusco It was rejected again.

The AEX index ended the week on a decline, losing 0.7% to close at more than 714 points.

Top three risers/fallers

Source: IEX.nl

the pharmacy

Things are going well for Leiden’s Pharming. Q3 numbers showed encouraging growth in sales volumes, Ruconest sales were strong, and Joenja’s first sales volume is now in the books. Investors will be allowed to do so in the near future Otherwise as expected:

Ruconest sales boost Pharming IEX Premium sales https://t.co/4ylC2DMqVX during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

Amazon

Amazon had a strong quarter, mainly due to its e-commerce activities. AWS growth was again moderate, but profitability improved. The fact that cloud growth is lagging behind rivals Microsoft and Alphabet may be due in part to Amazon lagging behind when it comes to AI capabilities. More at IEX Premium:

Amazon buys AI in IEX Premium https://t.co/0cSHhXZV1c during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

dead

The quarterly Meta numbers conjure up a bit of déjà vu. The results of the last quarter were impressive: growth in turnover by 23.2% to $34.1 billion and an increase in profits of no less than 163.5% to $11.6 billion. This increase is mainly due to lower expenses. Meta has cut costs significantly, including by reducing its workforce. Now she is taking advantage of this:

Meta wants to invest more but is not sure about the turnover in 2024 IEX Premium https://t.co/QnWIRVf8HI during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

Sanofi

Sanofi shares fell sharply on the stock market today. The French pharmaceutical company is generally one of the less volatile stocks in the CAC 40, but that’s different this time. There is currently a minus of at least 17% on the board. This was not driven by disappointing Q3 numbers, but rather a disappointing strategy update. Additional analysis from Investors Desk It can be found here:

An ugly setback for Sanofi IEX Premium https://t.co/yHpaE1gVuS during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

Wide

The trading update for the Vastned retail fund seems like a bit of a hassle, because the fund doesn’t actually say anything and doesn’t seem to want to say much either. This may make sense, since it is in the middle of a divestment program and discussions about refinancing. However, investors should be able to get more guidance. Additional analysis from IEX Investors Desk:

Vastned: Focus on refinancing and divestment of IEX Premium https://t.co/piYAaCy8ox during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

Unibel

Unibail-Rodamco-Westfield (URW) also performed well operationally in the third quarter. Organic gross rental growth accelerated to 11.5% during the first nine months. The URW therefore succeeds well in passing on inflation. There is still no news of major divestments in the United States. More at IEX Premium:

There is still no clarity on Unibail-Rodamco-Westfield IEX Premium’s dividend https://t.co/3EpV5Tl23p during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

IEX Investor Podcast

It’s Friday again and that means another Real IEX Investor Podcast for IEX regulars! A lot is happening in the financial markets right now, especially with many Q3 numbers coming in and thus more than enough to discuss, such as: Adyen, Unilever, Microsoft, Philips, Flow Traders and more.

You can listen to the podcast here:

IEX BeleggersPodcast: This looks like a bear market IEXnl https://t.co/g6yzBmfcyH during @IEXnl

— IEX Investors Desk (@Beleggersdesk) October 27, 2023

Wall Street

In the United States, financial markets opened mixed, with some losses for the Dow Jones index and gains for the S&P 500 and Nasdaq indices. stronghold (-9%) suffered a setback after yesterday’s trading as well Major oil companies Exxon Moving (- 2 f Chevron (-5%) was somewhat disappointing. A solid profit was booked for it Amazon (+8%) and Intel Corporation (+9%).

At the end of European trading, the Dow Jones index fell by 0.1%, the S&P 500 index rose by 0.4%, while the Nasdaq index rebounded by 1.3%.

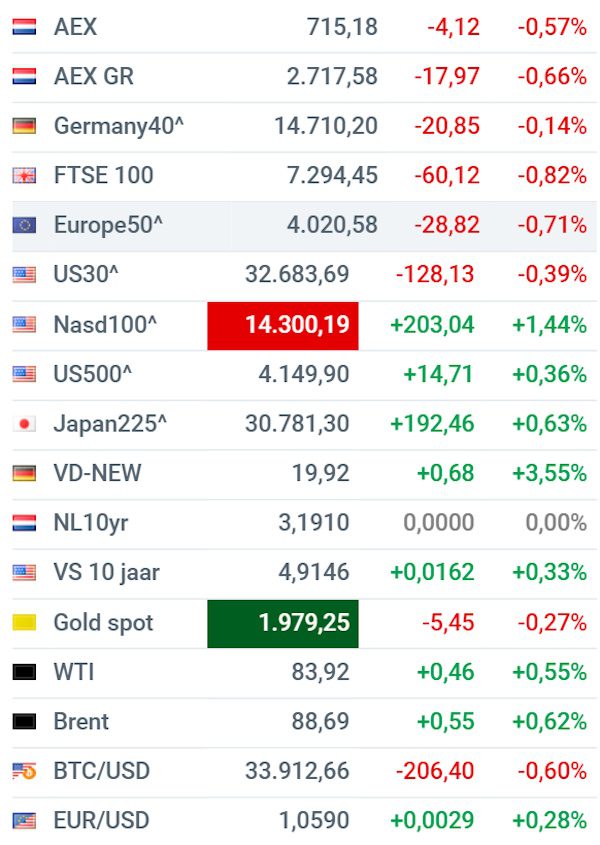

Interests

Also a relatively quiet day in international bond markets. Most interest rates have taken a modest step back. This will likely bring some relief, especially in Italy, although a 4.8% interest rate is also unsustainable for Italians in the long term.

- The ten-year interest rate in the Netherlands is 3.19% (minus two basis points)

- Ten-year interest rate Germany 2.82% (minus 3 basis points)

- The ten-year interest rate in France is 3.46% (minus 2 basis points)

- The 10-year interest rate in Italy is 4.80% (minus 6 basis points)

- US 10-year interest rate 4.85% (plus 1 basis point)

- The UK 10-year interest rate is 4.59% (minus one basis point)

Wide market

The broader market presented a relatively calm picture, with few really notable outliers. The sentiment is certainly not good yet, at least it is viewed with a bullish outlook. Small losses, mostly in Europe, Wall Street divided, little movement, although VIX creeps towards 20. Gold and oil barely move, as does Bitcoin, while EUR/USD stabilizes around 1.06.

Source: IEX.nl

Destruction

- DSM Firmenich (+1.2%) He’s been in the corner with the shots falling for some time and can be seen Fallen angel. This is the second question

- Unilever (-2.3%) It may have suffered from an uninspired strategy update from the new CEO, but Q3 numbers were good

- UMG (-7.2%) did not fully meet market expectations with the third quarter numbers

- AF-KLM (+0.4%) also has numbers, but it cannot be taken seriously as an investment, although the Dutch government undoubtedly thinks otherwise.

- Corbion (-0.1%) in somewhat difficult weather and the expected sale of the American segment is delayed

- Signai (+5.1%) had a slightly better margin than expected in the third quarter, but the results were certainly not great

- B&S Group (-1.2%) It suddenly rose late Friday afternoon last week, there was no news, and is now falling just as easily.

- the pharmacy (+0.7%) Yesterday they delivered a strong set of Q3 numbers and were rewarded for doing so for the second day in a row

- Wide (+7.0%) appears to have been only marginally rewarded relative to yesterday’s Q3 numbers

- Working in the local market GeoJunxion (+21.4%) who want to sell all their activities

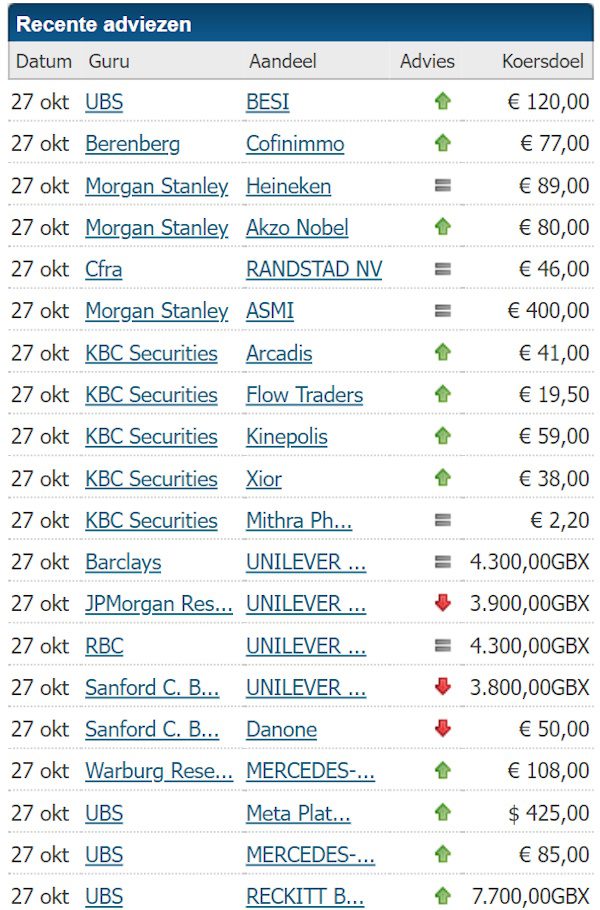

Tip (Source: Guruwatch.nl)

Agenda for October 30

06:30 Producer Prices – September (Netherlands)

06:30 Producer confidence – October (Netherlands)

11:00 Consumer Confidence and Economic Sentiment – October Final (Euro)

13:00 McDonald’s – Q3 numbers (US)

14:00 Inflation – October vlpg (DLD)

Then this

Amazon sees reluctant consumers

Amazon is in a cautious mood ahead of the key holiday shopping season. The e-commerce giant said consumers were cautious about spending https://t.co/9RG7UXU1Ow pic.twitter.com/BGvJAHtppY

– Reuters (@Reuters) October 27, 2023

Germany’s energy transition is far from successful

Good morning from Germany, where the transition to green energy costs not only consumers, but also shareholders of green energy companies. For example, Siemens Energy saw a significant decline in its stock market value, losing nearly €20 billion of ATH. In fact, when adding values… pic.twitter.com/J0vhwe5O11

– Holger Schäpitz (@Schuldensuehner) October 27, 2023

The market usually misses the point about the Fed

Wall Street economists warn that the market is almost always wrong about what the Fed will do next https://t.co/6FPracFHiL

– MarketWatch (@MarketWatch) October 27, 2023

Quality has no price

A £760 steak from Japan should be well done https://t.co/ovRwDEEG3e | opinion

– Financial Times (@FT) October 27, 2023

Chevron numbers fall short

Chevron’s profits were lower than analysts’ expectations despite strengthening oil and fuel markets https://t.co/n84lrfSQ2N

– Bloomberg Markets (@markets) October 27, 2023

Sanofi disappoints investors

Breakingviews – Investors reject Sanofi treatment for patient evaluation https://t.co/3bBpB8yWcS

— Reuters Business (@ReutersBiz) October 27, 2023

Martin Crum is a senior investment analyst. The information in this column is not intended to provide professional investment advice or a recommendation to make specific investments. Chrome can take positions in the financial markets.