It’s now code orange in large parts of our country, but in Damrak it’s code green, after the S&P 500 hit new record highs on Friday. Not much is expected: Investors will no doubt want to keep their stocks dry in light of the data frenzy, US inflation numbers and the European interest rate decision later this week.

In Asia last night we witnessed the same story as in recent weeks: the Nikkei index stole the show, while the leak in China is far from over.

The Bank of Japan will make an interest rate decision tomorrow, but loose monetary policy is generally expected to continue for the time being. This provides support to the Japanese stock market.

In China, the People’s Bank of China decided not to cut interest rates on loans with terms ranging from one to five years, which is putting pressure on real estate stock prices in particular. In addition, there are persistent concerns about the slow economic recovery in China after the Corona pandemic.

Technology stocks are doing well, except for China. For example, Samsung and TSMC are both up 1%, but the share of Prosus Tencent (-2.6%) and Alibaba (-0.5%) is falling.

The positions of the most important indicators are as follows:

- Nikkei 225: +1.6%

- Shanghai Shenzhen CSI 300: -1.6%

- Hang Seng (Hong Kong): -2.7%

- Cosby (South Korea): -0.3%

The S&P 500 continues to reach all-time highs

Before the weekend, US stock markets managed to close sharply higher. The Standard & Poor’s 500 index closed 1.2% higher at 4,839.81 points, breaking the record set in two years. The Dow Jones rose 1.1% and the Nasdaq rose 1.7%.

Chip stocks like Nvidia, Broadcom, Synopsys, Qualcomm and AMD had a fun after party on Thursday, which celebrated higher numbers from TSMC.

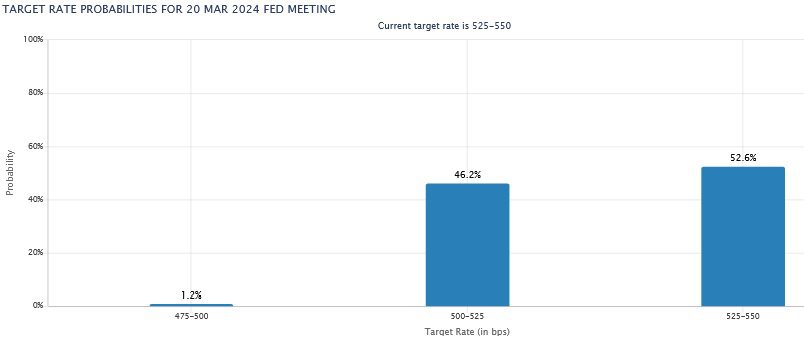

Meanwhile, financial markets are beginning to realize that the first interest rate cut will take several months. Economists have already agreed that the Fed will leave interest rates unchanged next week. But the probability of continuing to cut interest rates in March has now shrunk to less than 50%, as can be concluded from the so-called FedWatch tool from CME Group. More than a week ago, the percentage was still more than 80%.

Here are the forecasts for March:

Although it can’t happen fast enough for many investors, increasing interest rates too early could be counterproductive, as analyst Martin Crum explained in yesterday’s report. He mentions five other risks for investors this year.

Milieudefensie calls ING to account

Keep an eye on ING for more information. After Shell, this bank is now facing a climate issue. Milieudefensie demands that ING halve its emissions by 2030 and stop cooperating with polluting companies that put the future at risk. ING is accused of financing oil and gas companies and heavy industries that exacerbate deforestation and the climate crisis. Despite some recent adjustments to its climate policy, Melodydefense notes that ING is still far from doing enough and will continue to invest in new oil and gas projects until 2040.

Milieudefensie also warns other polluting companies and continues to increase pressure.

Indicators:

- European futures turn green

- In Asia we see the divide again: gains in Japan and South Korea, and continuing losses in China.

- The CBOE VIX (volatility) index fell slightly to 13.30

- The euro is rising slightly against the dollar and is trading at $1.0905

- The Dutch 10-year interest rate fell by 1 basis point at 2.601%, and the US interest rate fell by 2 basis points at 4.121%.

- The price of gold fell 0.4% to $2,019.69 per ounce. The price of gold has been volatile for some time ranges Between $1,675 and $2,075, but the long-term trend is up, as technical analyst Wouter Sloat showed today.

- Oil prices are down about 1%. West Texas Intermediate crude costs $72.86 per barrel, while Brent crude costs $78.06.

- Bitcoin drops significantly: by 1.3%. You can buy the coin now for $41,065.87.

The AEX index is expected to open 0.55% higher.

News, advice, shorts and agenda

Top stories from ABM Financial News:

07:40: Berenberg significantly raises ASML and ASMI price targets

07:24: The Netherlands is investing less

07:21: House prices are rising again

07:19: Sharply divided picture in Asian stock markets

07:07: European stock markets are expected to open higher

IEX also produces an overview of the most important news stories in the morning newspapers each morning. You can find that overview here.

AFM reports this Shorts. There’s Alvin again.

advice

Two strong price target increases for ASML and ASMI. Two small discounts for Ahold Delhaize.

In the lead-up to Wednesday’s figures, ASML received a buy recommendation from 18 banks and a hold recommendation from two banks.

- ASML: to 880 euros from 710 euros and buy – Berenberg

- ASMI: to 560 euros from 450 euros and buy – Berenberg

- Ahold Delhaize: To €28 from €29 and hold – Sanford C. Bernstein & Co

- Ahold Delhaize: To 29 euros from 30 euros and a contract – Barclays

- Euronext: from €93 to €102 and buy – JPMorgan

- ABN Amro: from €16.00 to €19.30 while retaining RBC

- Unilever: to 5,110 pence from 5,290 pence and buy – Berenberg

Agenda: The calm before the storm

If you looked outside and saw an Isha storm raging you wouldn’t know it, but in the gallery, it’s truly the calm before the storm. At least three interest rate decisions are coming. The macroeconomic calendar is busy, including US economic growth in the fourth quarter and US personal consumption expenditures inflation. Several companies provide numbers, including ASML, Netflix, IBM, and Tesla.

But that’s all for later this week.

- Today: Leading Indicators

Today we have to be satisfied with the leading indicators in the United States, to which the markets in general do not respond. JDE Peet’s stake is €0.35 ex-dividend.

- Tuesday: Japanese interest rate decision and several US numbers

Tomorrow, CBS will report on Dutch consumer confidence. The European number will follow at the end of the afternoon.

The Bank of Japan makes a decision on the interest rate. A few weeks ago, there were fears that the Bank of Japan would raise interest rates on grains, but hardly anyone believes it now. Inflation is falling, and the recent earthquake calls for restraint.

Earnings season resumes in the US. 3M, General Electric, Halliburton, Johnson & Johnson, Lockheed Martin, Procter & Gamble and Verizon release their numbers after lunch. After Wall Street closes, Netflix and Texas Instruments follow.

- Wednesday: ASML, IBM, Tesla

The day after tomorrow, all eyes will be on ASML, the first Dutch company to publish a full set of quarterly figures. That morning it was also the turn of the German company SAP and the British company Easyjet.

In the US, AT&T, Kimberly-Clark (after lunch), IBM and Tesla (after Wall Street close) open their Q4 books. Japanese, European and US composite PMIs are also in the program.

- Thursday: NSI, US GDP and ECB interest rate decision

Thursday will be a busy day, with numbers from NSI (pre-market), American Airlines, Comcast, Dow (at 1pm Dutch time), Intel and Visa (at 10pm). The macroeconomic calendar is well packed, with the German Ifo (business confidence index), the US Q4 GDP estimate, purchase orders for durable goods, and US new home sales figures.

Two central banks will also make an interest rate decision that day: the Central Bank of Turkey and the Eurozone. In Turkey, interest rates were raised again last month, from 40% to 42.5%. Another 2.5 percentage points could be added. Inflation there remains high (about 62%) and is expected to rise further. But the bank announced last month that it would press the brake pedal with less force as soon as possible.

More attention will be paid to the European Central Bank’s interest rate decision. The general expectation is that the deposit interest rate that banks receive on their excess reserves with the central bank will remain at 4%. We will have to be patient until interest rates are lowered, as many policymakers have hinted in recent weeks.

- Friday: WDP index and US PCE inflation

On Friday, Signify, WDP (pre-marketing), American Express and Colgate-Palmolive (1 p.m.) will publish their quarterly numbers. Later in the afternoon the number of options for owner-occupied homes in the United States will be published Last but not least PCE inflation in the United States, which the Federal Reserve looks at when making its interest rate decision.

Then this

Oh

Moody’s is negative on Asia’s sovereign creditworthiness in 2024 as growth slows in China https://t.co/lgRe4zmpnU

– CNBC (@CNBC) January 22, 2024

Supply chain problems and rising prices.. Will we face this again?

New inflationary pressures are accumulating here: the Suez Canal transit volume continues to decline. (Chart via SRP) pic.twitter.com/Tu2LgfoPzE

– Holger Schäpitz (@Schuldensuehner) January 21, 2024

There is a CEO exodus happening in the United States. Why?

Why are American CEOs resigning in record numbers in 2023? https://t.co/ZyqEzhJoBJ

– CNBC (@CNBC) January 22, 2024

Wait a little longer. According to FactSet, analysts expect margins to rise again after that, to 11.7% in the first quarter and 12.1% in the second quarter.

???? #SPX | S&P 500 Reports Lowest Net Profit Margin in Over 3 Years for Q4 – Factshttps://t.co/hUe17y2DBz pic.twitter.com/hrL17E5pFj

– Christophe Baroud???? (@C_Barraud) January 20, 2024

Does this put a floor on the price of Bitcoin?

#BitcoinPrice drop last week:

Although the “new” spot Bitcoin ETFs have attracted nearly $4 billion in assets, Greyscale’s outflow has been larger. But on Friday, the balance tipped, causing total outflows to fall from $3 billion to $2.5 billion. So this… pic.twitter.com/3198M6UIAs– Jeroen Blokland (@jsblokland) January 21, 2024

Good luck today!

“Lifelong zombie fanatic. Hardcore web practitioner. Thinker. Music expert. Unapologetic pop culture scholar.”