After opening bright green in Damrak, AEX ultimately closed down 0.4%. ASMI shareholders can look at the price tags with less sadness. Diver closed higher after expectations increased. However, the “only” price gain of 2.9% is somewhat disappointing after opening higher than 6% this morning.

Good news from Germany: Inflation has fallen faster than expected. In November, annual inflation fell to 10%. This is much lower than last month’s 10.4% and the consensus was also 10.4%.

Online shopping continues to gain momentum

E-commerce platform Shopify (+0.5%) puts small entrepreneurs on a highly scalable digital rocket. Not only does the platform ensure a huge online reach, but it also completely relieves entrepreneurs. Optimist Paul Whitling says:

However, the price has suffered a strong post-corona catastrophe this year now that physical stores are open again and the interest rate environment is completely different. Results are under pressure, because huge investments must be made to sustain growth. You can read all about it at Analysis from Shopify.

Shopify: Online shopping continues to gain momentum https://t.co/SBcUHwX0jA #IEX

– IEX.nl (IEXnl) November 29, 2022

Things have gone very quickly with Allianz

a path Allianz (+0.9%) has been on the rise since the third quarter numbers were published. The share price fell below 160 euros at the beginning of September, but after three months, there is a position of more than 200 euros on the board. “However, the results were not very special,” says analyst Niels Kuertz. “Turnover increased by 1.3% to €34.8 billion in the third quarter, but that is as a result of acquisitions and positive currency influence. Correcting this, the decline remained at 3.7%.”

The positive news therefore lies in the operating result, which increased by 7% in the third quarter to €3.5 billion. As a result, the insurer saw the opportunity to adjust its forecast for the full year and beyond. You can read in detail how this affects the advice and target price Allianz analysis.

a path #Allianz It has risen in a straight line since the third quarter earnings. So while the company’s numbers are not impressive. The increase in trading volume is entirely due to the positive influence of the currency and acquisitions.

Below you can read my analysis:https://t.co/Yzbhvw1AY6 pic.twitter.com/mvzBymiczF

– KoertsNiels November 29, 2022

Top 3 risers and fallers

Watch today’s winners and losers here.

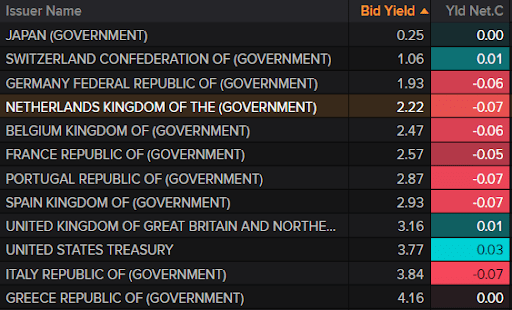

interests

Interest rates are going down today. The Dutch 10-year interest rate loses seven basis points thus reaching 2.22%.

broad market

- The AEX (-0.4%) fared worse than the German DAX (-0.1%) and the French CAC 40 (+0.1%).

- The CBOE VIX (volatility) rose to 22.3 points.

- Wall Street is quoted as follows: S&P 500 (-0.6%), Dow 30 (-0.5%) and Nasdaq (-0.8%).

- The euro remained at 1.034 against the US dollar.

- Gold (+0.6%) and silver (+1.4%) are on the rise.

- Oil: WTI (+0.5%) and Brent (+0.3%) are turning green.

- Bitcoin (+1.1%) is in the positive.

Damrak

- energy companies like coincidence (+1.8%) in the green today. Bloomberg wrote this morning that Saudi Arabia and other OPEC+ members are considering cutting production by 2 million barrels per day.

- ING has its own price target in the future Egon (+0.6%) reduced. The Buy rating remains in effect, but the price target has been revised down to €6.16.

- ASMI (+2.9%) raised its Q4 sales forecast because the impact of US export restrictions on China will be less than initially expected. ASMI will also be able to ship more orders. However, the Dutch semiconductor specialist remains cautious, says analyst Janardan Menon of Jefferies.

- VOBAC (+0.8%) is green today, because the Norwegian maritime group Wilhelmsen Port Services wants to acquire Vopak Agencies and with Vopak Ventures BV also acquire Vopak’s subsidiary Diize BV.

- aperam (+ 3.6%) They are increasingly trying to form a recovery. The new higher price lower indicates an increase in demand for the stock. Read more about it in the update Tostrams website.

- fasted (+0.1%) announced a new bond issue on Tuesday. It is a bond with a term of 4.5 years and a coupon of 5%. Proceeds from the issue will be used to fund further expansion of the Fastned fast charging network and for general corporate purposes. The bonds are sold for €1,000 each.

Tip (Source: Guruwatch.nl)

- Aegon: to €6.16 from €6.30 and buy – ING

- Just takeaway: up to €40 from €60 and Buy – ING

- AkzoNobel: up to €84 from €77 and buy – Goldman Sachs

Agenda Wednesday 30 November

00:00 ANE – Third quarter numbers

03:30 Manufacturing and Services PMI – Nov (chi)

06:30 Retail Sales Volume – Oct (NL)

06:30 Producer Prices – Oct (NL)

08:45 Inflation – Nov vlpg (Fra)

08:45 Economic Growth – Third Quarter Finals (French)

09:55 Unemployment Rate – October (Germany)

11:00 inflation – november vlpg (euro)

11:00 Economic Growth – Third Quarter (Invitational)

1:00 PM Mortgage Applications – Weekly (US)

2:15 PM ADP Jobs Report – November (US)

14:30 Economic Growth – Estimates for the Second Third Quarter (USA)

3:45pm Chicago PMI – November (US)

4:00 PM – Jobs – October (US)

4:00pm Upcoming Home Sales – October (US)

4:30 PM Oil Inventories – Weekly (US)

20:00 Federal Reserve – Beige Book (US)

22:00 Salesforce – US third quarter numbers

22:00 Snowflake – Q2 numbers (US)

Quinn Gruters is the editor of IEX. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. click here For an overview of IEX Editors’ investments.