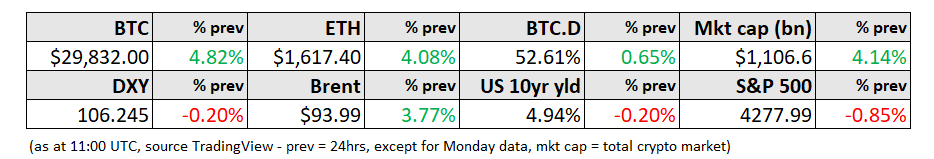

Bitcoin (BTC) rose nearly 11 percent last week and is back at nearly $30,000 at the time of writing. This coming week could be crucial for the price of Bitcoin, which is why it is so important to take a close look at key macroeconomic data points.

What will we present next week?

- New decision on interest rates from the European Central Bank

- The US central bank’s preferred measure of inflation

- United States gross domestic product (GDP)

- A set of purchasing managers’ indices (the main health indicator of the economy)

🎁 This week: Trade your first €10,000 of cryptocurrencies absolutely free

An important period for the price of Bitcoin

Last week, US Federal Reserve Chairman Jerome Powell made some tough statements during a speech in New York. If inflation remains at the current level, and the economy and labor market remain healthy, he believes it is very likely that we will see new interest rate increases.

However, it seems that the market no longer believes this, as we can also see from the price of Bitcoin. If the US central bank actually raised interest rates, the Bitcoin price would not behave as it does now.

Although of course this also has to do with the optimism surrounding the Bitcoin ETF. Cointelegraph’s fake news about a Bitcoin ETF being approved in the US appears to be coming to fruition.

The market has gotten a taste of what actual approval for Bitcoin could mean.

What can we expect next week?

Investors hope that Bitcoin will become… rising The momentum could continue next week. To this end, it is important that the ECB does not increase interest rates further. The chance of this happening seems high, as the ECB has little room to increase interest rates due to the weakness of its Eurozone counterparts (such as Italy).

It is therefore expected that the European Central Bank will have to cut interest rates again much sooner than the US Federal Reserve in order to slow the recession. This is why we see the US dollar performing well against the Euro.

Moreover, the US economy’s GDP is on the agenda. This should arrive on Thursday and the forecast is for economic growth of 4.3% over the past quarter (extended year-on-year).

This is tremendous growth and also explains why the US dollar is performing so well at the moment. This gives the US central bank room to keep interest rates at this high level for a longer period.

The only drawback of a strong economy is that it keeps inflation at a higher level (after all, people continue to consume). This is not good news for the Bitcoin price, because we will have to make do with rising interest rates for a while longer.

Sometimes it seems like we can’t overcome this inflation without recession… and that’s a bleak outcome.