The AEX is -0.1% at 630 after a miserable Wall Street, which was slightly shocked by the Fed.

It is now red in Asia, with the yen hitting new lows. The TSMC is down -0.5% in the third quarter and I set the alarm for 2:30pm because then there is inflation in the US.

- European and American futures are all around -0.1%

- In Asia, only China is a few tenths higher, the rest a few tenths lower. However, Taiwan -2.0% and Korea -1.3%

- Volatility (CBOE VIX Index) is -0.2% at 33.6

- The dollar at 0.9706

- Gold is down -0.2%, Oil is up +0.2% again, and Crypto is down a few tenths

Interest rates are now slightly lower, and this may give some air to stocks. You probably shouldn’t expect much from all prices for this inflation number.

This number is looking up the market today and beware, the last time prices fell sharply on the back of a small setback. US consumer prices for September are shown, i.e. inflation. For stocks, the number is hopefully better than expected, because the Fed has its teeth when it comes to inflation.

That was evident again from Minutes The latest interest rate decision and here and there speeches by presidents and officials. Again, inflation must return to the US and will return, if necessary at the expense of the economy.

For the participating writers, this is the complete consensus:

On the Damrak, vajron is neat and routine Q3sthat meet expectations.

NSI is also there with Q3 numbers, raises profit expectations and I’m still finding these lines from the press release. The fund might reorganize and rethink its strategy if it didn’t change those FBI rules that were so bad for it.

- The potential abolition of the FBI system in 2024 significantly distorts the equality of opportunity for the listed Dutch real estate sector

- Mitigation measures by the government are necessary; Otherwise, NSI will have to restructure the business/taxes

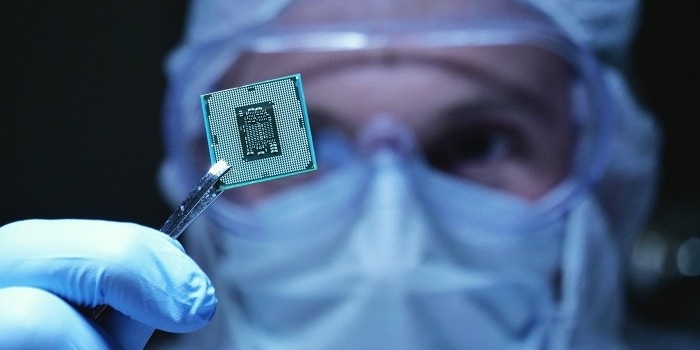

Is there any technology or bad news, you wonder? Applied Materials is sure to warn that it will be hurt by the latest series of US semiconductor actions against China. Not unexpectedly, it seems, because the course was presented Just hours later 0.6% at a modest turnover.

Applied Materials cuts quarterly revenue and profit estimates on Chinese export restrictions https://t.co/uN6hRx4ucw pic.twitter.com/Uwgo18qRBJ

Reuters Business (ReutersBiz) October 13, 2022

ASML Should Also Deal With China’s New Rules?

Below is a summary of the numbers from TSMC, which are -0.5%.

Good luck everyone today with our AEX in the fresh bottoms and our interest in the new highs. I don’t think everyone is happy with these trends.

News, short tips and agenda

The most important ABM Financial news since the Amsterdam closed yesterday.

- 08:21 FIL Bigger in Just Eat Takeaway

- 08:18 TSMC profits beat expectations

- 08:13 RoodMicrotec sees huge increase in income

- 08:05 German inflation continues to rise

- 08:01 AEX starts slightly lower in anticipation of US inflation

- 07:41 “ASML bans US employees from providing services to China”

- 07:29 NSI raises profit forecast

- 07:19 Vajron scores more spins

- 06:59 European stocks opened lower

- 06:52 Stock Market Agenda: Macroeconomics

- 06:51 Exhibition agenda: Dutch companies

- 06:51 Exhibition Agenda: Foreign Funds

- October 12 stock update: AEX on Wall Street

- On October 12, Wall Street closed slightly lower

- October 12, the price of oil closed lower

- October 12, Federal Reserve meeting minutes show concerns about persistently high inflation

- October 12 Wall Street heads towards a steady close

- October 12 The White House is considering a ban on Russian aluminum – Media

- October 12 European stocks closed lower

AFM reports this shorts And our dear helper, how many there are:

You’re probably curious about this, he doesn’t want to get any less:

You may also be interested in this name:

schedule of work:

07:00 Fajroon – Third Quarter Numbers

07:00 NSI – Third Quarter Numbers

08:00 Road Microtech – Third Quarter Numbers

00:00 TSMC – Third Quarter Numbers (TAY)

12:00 BlackRock – US Q3 numbers

13:00 Delta Air Lines – US Third Quarter Numbers

00:00 Details of the new US trade measures for the chip industry

08:00 Inflation – September Final (German)

10:00 IEA – Monthly Report (Fra)

14:30 Support Requests – Weekly (US)

14:30 Inflation – September (US)

17:00 Oil Inventories – Weekly (US)

then this

intermittent sessionIt’s a nice expression:

Watch: US stocks ended the choppy session slightly lower after the Federal Reserve’s meeting minutes showed that policy makers agreed they need to maintain a more restrictive stance on policy. Investors also expected the consumer price inflation report to be released on Thursday https://t.co/ncNxVTzn04 pic.twitter.com/9yqRFexQof

Reuters Business (ReutersBiz) October 13, 2022

grim:

BREAKING: Fed officials expect high interest rates to stay on, according to meeting minuteshttps://t.co/J2jEcq27yS

– CNBC Now (@CNBCnow) October 12 2022

This could cause a geopolitical shift. The Saudis are dealing with the Russians, they seem to be talking secretly with Israel, and perhaps China is watching too.

Watch: US President Biden said he would consider legislation to punish Saudi Arabia for joining its OPEC allies in cutting global oil supplies. pic.twitter.com/McQePuSl5a

Reuters Business (ReutersBiz) October 13, 2022

Great interests:

Exclusive: US officials fear their plan to cap the price of Russian oil is at risk of failure after OPEC+ production cut https://t.co/soWntDaSYs

– Bloomberg Markets October 13, 2022

And the benefit:

Strikes, potential power outages, currency plunge: Britain is facing a wave of bad news https://t.co/xFFRNsqDMz

– CNBC October 13, 2022

Do we almost forget the Chinese real estate market:

Some local governments in China are buying homes in bulk from developers or encouraging state-owned entities to do so in their recent efforts to bolster the property market, the Securities Times reported Thursday. https://t.co/qXVlEfcE9E

– Bloomberg Markets October 13, 2022

This is not the year to invest in ESG:

BlackRock CEO Larry Fink has said he is not against oil companies, and deals squarely with attacks on his company from a growing group of Republican-led states. https://t.co/I7pM7CcAVd

– Bloomberg Markets October 13, 2022

Oh yeah dead. Still there.

Meta introduced a new headphone called Meta Quest Pro. It will be a “mixed reality” headset, supporting both full virtual reality and augmented reality. Watch the video to learn more. https://t.co/MOV9VYf1v2 pic.twitter.com/bPYm3a6c75

– CNBC October 13, 2022

AMC at its lowest price since the big crises:

AMC hit a new 52-week low on Wednesday as the movie theater company struggles with a massive debt burden, dilution of its inventory and a short film release schedule in blockbuster movies.https://t.co/Lcs4lPamoT

– Sarah Whitten (@sarahwhit10) October 12 2022

You still want to eat and drink.

PepsiCo raised its annual revenue and profit forecast as demand for soft drinks and snacks remained resilient despite higher prices. Read more here: https://t.co/duvQQdFOVN $ PEP pic.twitter.com/2Mkhad4Nsj

Reuters Business (ReutersBiz) October 13, 2022

It is this guy’s timeline. Except for cars and missiles:

– Elon Musk October 13, 2022

Is it also good?

The best perfume on earth!https://t.co/ohjWxNX5ZC pic.twitter.com/0J1lmREOBS

– Elon Musk October 11 2022

haha!

Please buy my perfume, so I can buy Twitter

– Elon Musk October 12 2022

Enjoy and good luck today.