Take into account the lackluster trading day. Investors are basically waiting to see what the Fed does tonight, and until then they seem to want to keep things as they are. Futures point to an opening gain of 0.1%.

There’s not much news this morning. Fugro will begin purchasing 2 million shares of its own today and expects to complete this before June 1. IMC is making an acquisition in South America. Furthermore, German producer prices appear to have fallen further, which is of course good news for inflation.

We are still waiting for Avantium numbers. Kapka came in last night and pulled two rabbits out of the hat.

Cabka cuts margin target and sees CEO depart

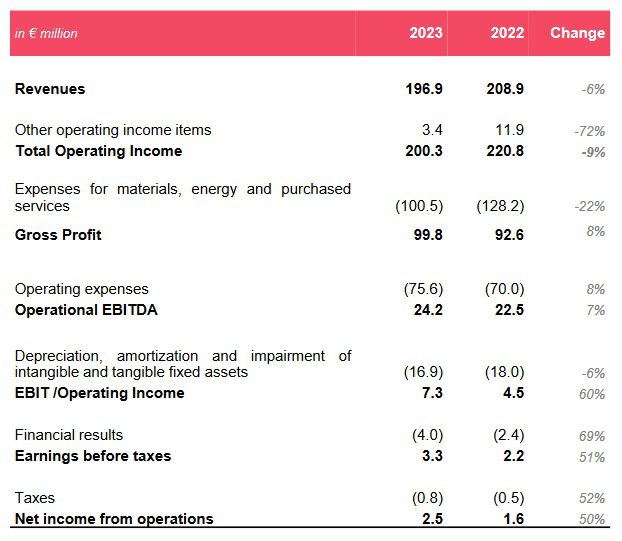

The manufacturer of recycled pallets, Cabka, had already published interim figures last month. This showed that sales in the fourth quarter increased by 35% compared to the previous quarter. Total turnover for 2023 was just under €197 million. That was 6% lower than the previous year and €3 million less than Kapka’s own forecasts.

now The final numbers came, but they carried some surprises. The group is forced to reduce its EBITDA margin target for 2026 from 20 to 17%. EBITDA margin rose last year from 10.8% to 12.3%, and is expected to rise further to 13 to 15% this year.

The second surprise was the announcement of CEO Tim Litjens’ departure near the end of the third quarter.

Here are the highlights:

Source: Kapka

Cosby in a lackluster stock market without Japan

In Asia, investors were forced to do without Japan last night, which kept its doors closed on the occasion of the spring equinox (celebrating the arrival of spring). The rest of the stock markets took it easy, in light of the Fed’s interest rate decision. Only the Kospi index in South Korea did very well. This was thanks to Samsung, which was allowed to supply memory chips to Nvidia.

In late China The People’s Bank of China leaves key interest rates unchanged. The previous day, the Bank of Japan decided to raise interest rates for the first time in 17 years, but the accompanying commentary was quite “pessimistic.” There was no mention of further normalization of interest rates.

Here are the positions of the most important indices at a glance, at 7:55 a.m.:

- Nikkei 225: Closed

- Shanghai Shenzhen CSI 300: +0.1%

- Hang Seng (Hong Kong): +0.3%

- Cosby (South Korea): +1.3%

For Prosus shareholders, the increase in Tencent’s stock price is welcome. And see Samsung Pop:

- Samsung +5.8%

- Alibaba: +0.07%

- Baidu: +0.2%

- Prosus Tencent Share: +1.5%

- TSMC: -0.5%

Wall Street closes higher ahead of the Fed’s interest rate decision

Wall Street’s major indices finished higher again on Tuesday in the run-up to the US interest rate decision, at 7:00pm Netherlands time. The Standard & Poor’s 500 index rose 0.6% to 5,178.51 points. The Dow Jones index closed up by 0.8%, and the Nasdaq index rose by 0.4%.

super micro computer, Which just entered the S&P 500 index, got a major makeover after the company announced a bid. 2 million shares will be issued, but there could be more. The price was already under pressure on Monday, and the next day it fell another 9%. If we zoom out further, we see an impressive return of 217% YTD and 821% in the last twelve months.

Nvidia It introduced its latest super-chip artificial intelligence and software on Monday evening. This did not lead to a significant jump in prices: the stock closed up 1.1%. Competitors Intel (-1.5%) and AMD (-4.8%) were forced to give up their positions.

The price of Bitcoin is still falling, and so are stocks Coinbase (-4%) Avoid exposure to cold.

Bloomberg News also reported this Boeing It is considering bringing at least two defense companies to the market. The aircraft manufacturer wants to strengthen its balance sheet with this. It’s important to note that the motivation for this is not, among other things, the tragedy of a missing door panel during an Alaska Airlines flight: the plans are said to be about a year old. Market reaction was lackluster. The price is up 0.7%, and the stock is down 28% since the beginning of the year.

Indicators:

- European stock markets are expected to open flat.

- The Japanese stock market was closed, Chinese stock markets were dull, but there was a scene in South Korea

- The CBOE VIX (volatility) index falls to 13.82.

- The euro is rising slightly and is trading at 1.0870 against the dollar.

- Ten-year bond yields rose sharply last week, as the realization emerges that we will be stuck with high interest rates for some time to come. But they calmed down. The Dutch ten-year interest rate is 2.696%. American by 4.9%.

- Gold price was slightly lower at $2,156.84 per ounce. For more information on the development of the gold price and the underperformance of mining stocks, I can highly recommend the column written by raw materials expert Quinn Lawers.

- Oil prices were still rising yesterday, but are falling again today. A barrel of WTI is now $82.36 (-0.2%) and a barrel of Brent is $86.28 (-0.9%).

- Bitcoin continues to decline. Today, it is down 0.8% and the cryptocurrency is trading at $62,072.12. This means that anyone who entered a week ago is today looking at a loss of $10,000.

The AEX is expected to open flat to slightly higher.

Contact: Do you have any questions about the IEX Investor Podcast?

This weekend, there will be recordings of the new IEX BeleggersPodcast. If you have any burning questions about it, you can ask them in the comments below these previews or via Spotify. Maybe your question will be answered then.

News, advice, shorts and agenda

- 08:14 British producer prices continue to fall

- 08:11 British inflation is lower than expected

- 08:08 German producer prices fell further

- 08:05 Flat open for AEX

- 07:29 IMCD acquires Bretano in Latin America

- 07:24 Fugro begins stock buyback program

- 07:20 Delen Private Bank acquires Dutch Box Consultants

- 07:18 Small gains in Asian stock markets

- 07:04 European stock markets are expected to open lower

- 06:54 China leaves interest rates unchanged

- 06:51 The Netherlands is investing less again

- 06:49 The Dutchman is less negative again

- 06:47 Stock Market Agenda: Macroeconomics

- 06:46 Stock Market Agenda: Foreign Funds

- 06:45 Exhibition agenda: Dutch companies

- Stock Market Update March 19: AEX on Wall Street

- March 19: Wall Street closed higher

- March 19: Oil prices rise

- March 19 – CAPCA reduces target margin after revenue decline and CEO departure

- March 19 Wall Street gains

- March 19: A significant drop in Gucci prices led to a capital turnover warning at Kering

- March 19: European stock markets close higher

- March 19 Final Call: Stock Exchange turns a blind eye to other exchanges over Unilever’s actions

- March 19, Maor Investment Company increases its stake in Fagron Company

IEX also produces an overview of the most important news stories in the morning newspapers each morning. A full news overview can be found here.

AFM reports this Shorts.

advice

Many investment banks have thought about this Unileverfollowing the announced split of the Ice Division, but this did not lead to adjustments in target prices or tips.

It’s also quiet on this front. Yesterday I welcomed a newcomer to the stock market Theon International Fan Mail (Manufacturer of Night Vision Goggles) from UBS. The Swiss Investment Bank decided to pursue the stock and immediately include it on its buy list. The target price is €17, which equates to an upside of €4.30 compared to the current price.

Agenda: What will the Fed do?

You’ve already seen Kapka’s characters. At lunch, biotechnology company BioNTech and food manufacturer General Mills open their books, and after Wall Street closes, Micron Technology comes in. Icelandic slaughtering machine manufacturer Marel holds its annual meeting today.

But most of the attention will undoubtedly be on the Fed’s interest rate decision, at 7:00pm Dutch time (note: an hour earlier than usual, due to US daylight saving time).

The interest rate decision itself probably will not be exciting. Almost everyone assumes that the Fed Federal funds rate (key interest rate) at 5.25 to 5.50%. However, the interpretation of the interest rate decision, dot plot and economic forecast can certainly move the financial markets. You can read how it works in this preview.

IEX will be reporting live on the interest rate decision and subsequent press conference tonight, so keep an eye on the website.

Also be careful not to be overly optimistic. Economist and columnist Edin Mojacek told investors in the latest IEX Investors Podcast that they should take into account that interest rates may not fall at all this year. Worth a listen, if you haven’t already:

IEX BeleggersPodcast with economist Edin Mujacik and analyst Martin Crum: Low interest rates this year is not a race at all – https://t.co/t1ZeNr9kk7 during @IEXnl

— IEX.nl (@IEXnl) March 15, 2024

Below is the full agenda for the rest of the day:

- 09:00 Mariel, Annual Meeting

- 12:00 US time, Mortgage Applications – Weekly

- 12:00 BioNTech (US), Q4 numbers

- 12:00 General Mills (US) time, Q3 numbers

- 3:30 PM, US Oil Inventories – Weekly

- 7:00 PM US and Fed interest rate decision + economic estimates and dot plot

- 7:30 PM in the US, clarification of the Federal Reserve’s interest rate decision

- 9:00 PM Micron Technology, Q2 numbers

Then this:

Meanwhile in Saudi Arabia

Saudi Arabia plans to pay $40 billion to artificial intelligence. The planned technology fund would make Saudi Arabia the world’s largest investor in artificial intelligence. It will also showcase the oil-rich nation’s global business ambitions as well as its efforts to diversify its economy and establish itself as a more… pic.twitter.com/2KjDkR2rka

– Holger Schäpitz (@Schuldensuehner) March 19, 2024

It is by no means a final race

No interest rate cuts this year, is this possible?

Yes, it is very possible, writes critic Edin Mujagic.https://t.co/K2DnAE9rnq— IEXProfs (@IEXProfs) March 19, 2024

Times are changing for big tech companies, warns Nobel laureate Stiglitz

The companies that make money from our data (including medical, financial, and personal geolocation information) have spent years trying to equate freedom of expression with the “free flow of data.” But their arguments are weak @Joseph Stiglitz He explains. https://t.co/bKeCPnb5RD

— Project Syndicate (@ProSyn) March 19, 2024

Small businesses, value stocks, cheap technology and homebuilders are must-haves, according to experts:

Where to invest $100,000? Value consultants, small businesses, home builders, and cheaper technology, say https://t.co/R0RjzaLp7w

– Bloomberg (@business) March 20, 2024

Good luck and above all enjoy today!

“Lifelong zombie fanatic. Hardcore web practitioner. Thinker. Music expert. Unapologetic pop culture scholar.”