Outside the eyes of the average citizen, an intense war is taking place between China and the US (and the wider West). This war is about controlling critical resources. What exactly is going on?

Important raw materials Cobalt, lithium, nickel, copper and rare earth metals are vital to our modern economy. Without these raw materials it would be impossible to manufacture smartphones, medical devices and anything else with a chip and battery. They are also essential Defense industry In the production of advanced weapons systems.

Technologies that drive the energy transition, including electric vehicles (EVs), wind turbines, and solar panels, also rely heavily on these raw materials. Without adequate access to minerals, the West cannot achieve its ‘green ambitions’. It is International Energy Agency (IEA) It predicts that demand for minerals for green energy will be six times higher in 2020 than in 2020, as demand for minerals for use in EVs and battery storage will increase by at least 30 times. Lithium is experiencing rapid growth, with demand expected to increase more than 40-fold by 2040. Demand for graphite, cobalt and nickel will increase by 20 to 25 times. The expansion of electricity networks has doubled the demand for copper for the electricity network over the same period.

Demand growth for minerals, 2040 compared to 2020 (Source: IEA )

Chinese dominance

We’ve written before that the Chinese are increasingly dominating the field Gold And Friday. China is also now competing for important raw materials to win. The country has steadily built its position as a world leader in the mining and processing of critical raw materials over the past decades.

Beijing controlled It currently processes 60% of global rare earth production and nearly 90% of global production. Although China is not always the largest producer of battery raw materials, it often controls their processing. China’s refining share is 35% for nickel and 50 to 70% for lithium and cobalt. Chinese companies have also made substantial investments in overseas assets. This gives Beijing significant influence in the mining and manufacturing sectors in countries such as the Democratic Republic of Congo (DRC) and Indonesia.

This gives China a strategic advantage and makes the West vulnerable to supply chain disruptions as China can control market prices and availability. This is more than a possibility; The Chinese government has repeatedly used its control as a geopolitical tool. In December, China accepted this Export of technologies Rare earth magnets were previously banned for production Export restrictions Arranged in Gallic and Germanic.

Reduce dependence on China

The United States and its allies recognize the need to reduce China’s dependence on critical minerals. Biden has taken several steps to increase domestic manufacturing and processing. This is how the Inflation Act Introduced, it provides subsidies for the manufacture of EV batteries using minerals mined and processed in the United States or allied countries. In addition, strategic partnerships are an important part of the Western strategy to secure supplies of critical minerals.

The Chinese government lent money to African countries $160 billion to infrastructure projects through their ‘Belt and Road Initiative’. That number has declined dramatically in recent years. In 2022, China bought only a small amount of debt $1 billion For African countries compared to $8.5 billion in 2019. America is now trying to take advantage of this. In December 2022, the US signed the Tripartite Agreement Memorandum of Understanding With DRC and Zambia. The deal aims to create a complete value chain from mineral mining to battery manufacturing.

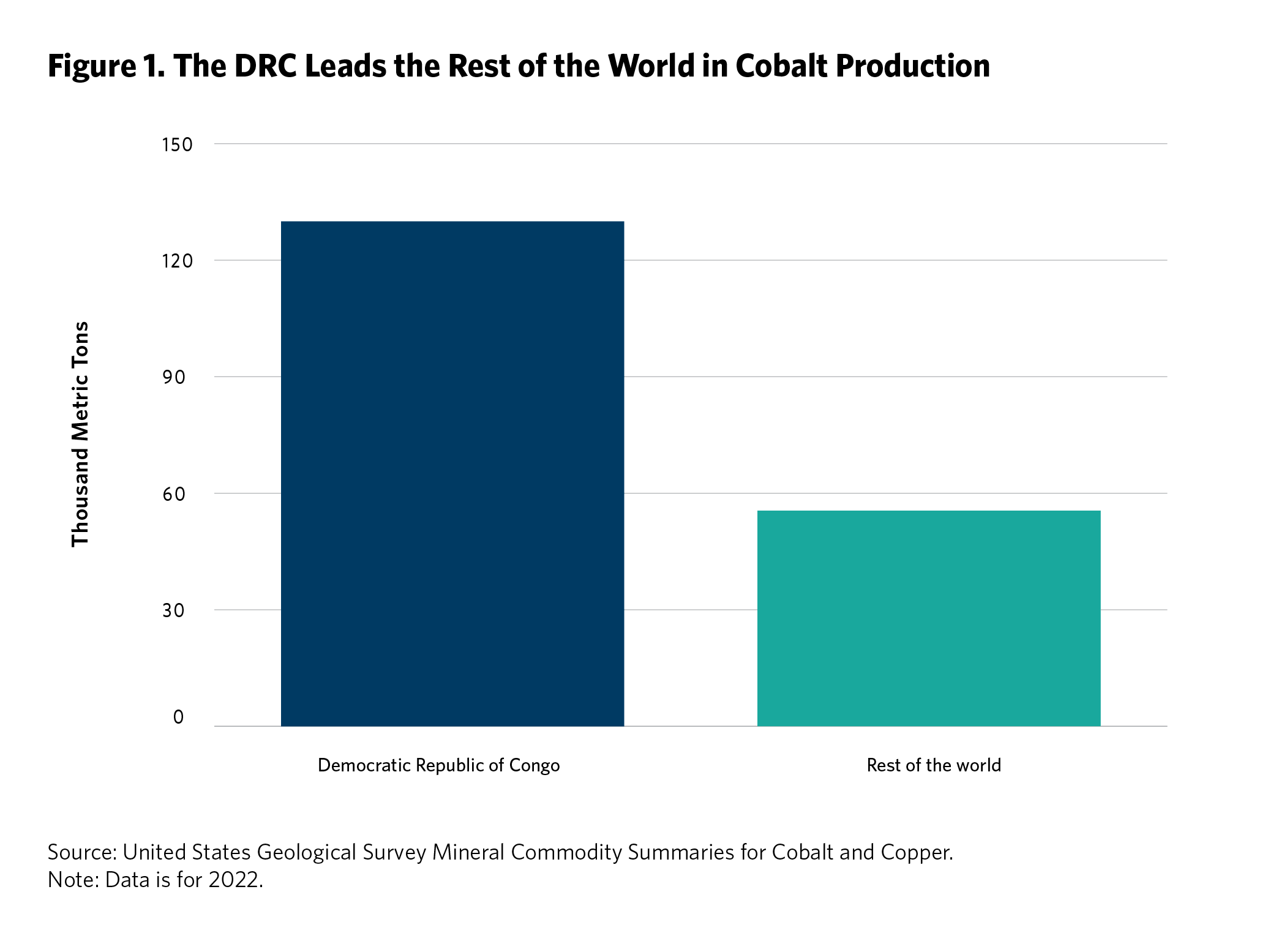

Cobalt production in DRC (source: Carnegie Endowmentst)

The DRC and Zambia are among the world leaders in the production of some important minerals. The DRC produces nearly 70 percent of the world’s cobalt in Katanga province and Zambia is one of Africa’s largest copper producers. So an important project that is not dependent on China is also aimed at those countries.

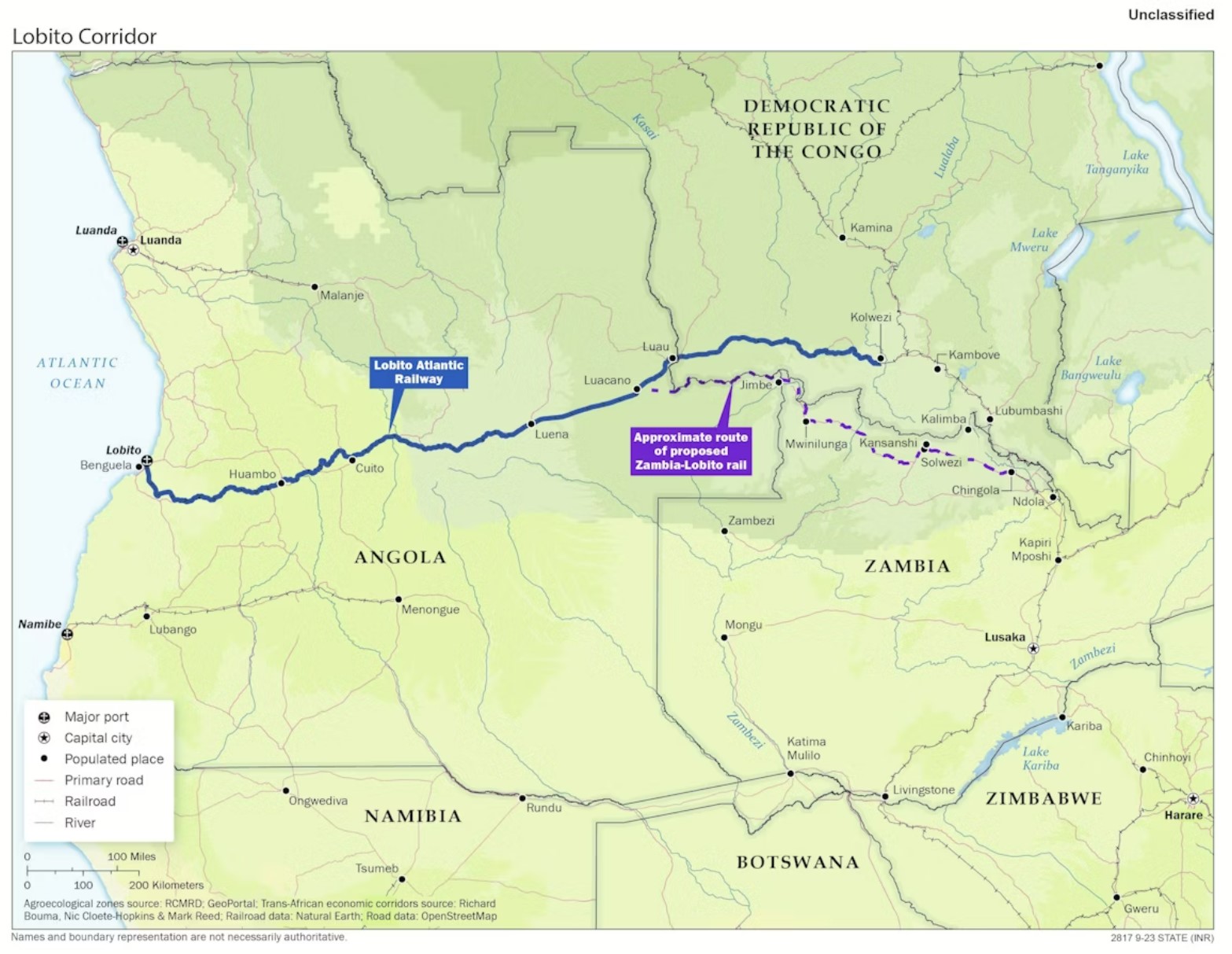

This program includes Investments Construction and Development of Rail Line in ‘Lobito Corridor’ Mineral-rich areas in the poorly accessible interior of the DRC and Zambia will be linked to an Angolan port on the Atlantic Ocean. The train will significantly reduce transit time from Katanga province and increase export opportunities. The West wants economic development across the region Encourage and develop.

Lobido Corridor Railway (Source: US Chamber of Commerce)

Conclusion

The battle for vital minerals is an important part of the broader geopolitical struggle between the US and China. Beijing currently dominates and is trying to maintain its position. The West wants to reduce its dependence on China for critical raw materials and is working hard to build its own supply chains. Projects like Lobito Corridor and Development Relations with African countries An important step in this direction, but for now China appears to be the dominant player in this market.

Also check us out Youtube channel

On behalf of Holland Gold, Paul Buendink interviews various economists and experts in the field of macroeconomics. The purpose of the podcast is to provide the viewer with a better picture and guidance on the increasingly rapidly changing macroeconomic and monetary landscape. Click here Subscribe.