Unemployment in the United States is rising faster than the Federal Reserve predicted.

This week, Fed Chairman Jerome Powell returned to his lecture and is expected to adopt a “modest” tone. Dovish wants to say he is less strict and will discuss options for faster rate cuts.

In other words: the macroeconomic environment is starting to become increasingly favorable for Bitcoin, but there are still risks.

The macroeconomic environment is very favorable for Bitcoin

In recent weeks we have seen a sudden drop in inflation in the US. At the start of 2024, we were surprised by relatively high inflation figures, leading to fears of a so-called second wave of inflation.

Now that inflation hike looks like an exception and we’re still heading toward the Federal Reserve’s desired 2.0%.

This is supported by the growth of unemployment in the US which was 4.1% last Friday. This 0.1% is higher than the 4.0% set by the Federal Reserve by the end of 2024. predicted.

This means that inflation appears to be falling to the desired level faster than expected, as the US economy begins to falter. This allows interest rates to drop quickly and is in principle positive for Bitcoin. But there is danger.

Another recession in America?

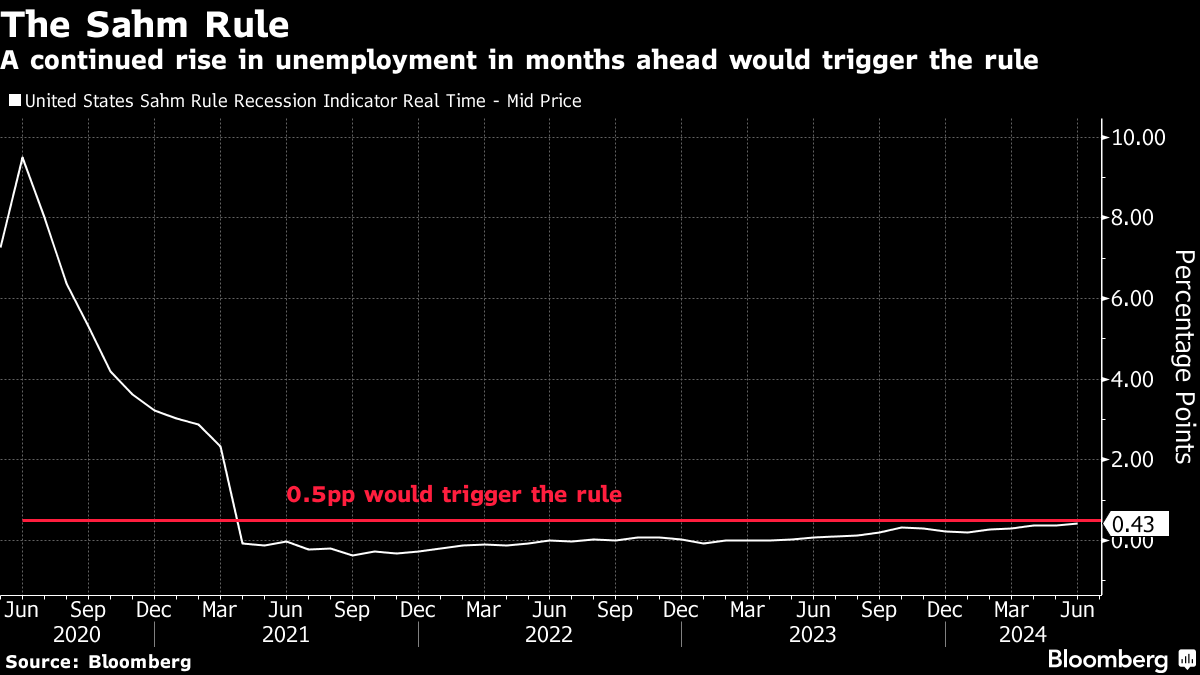

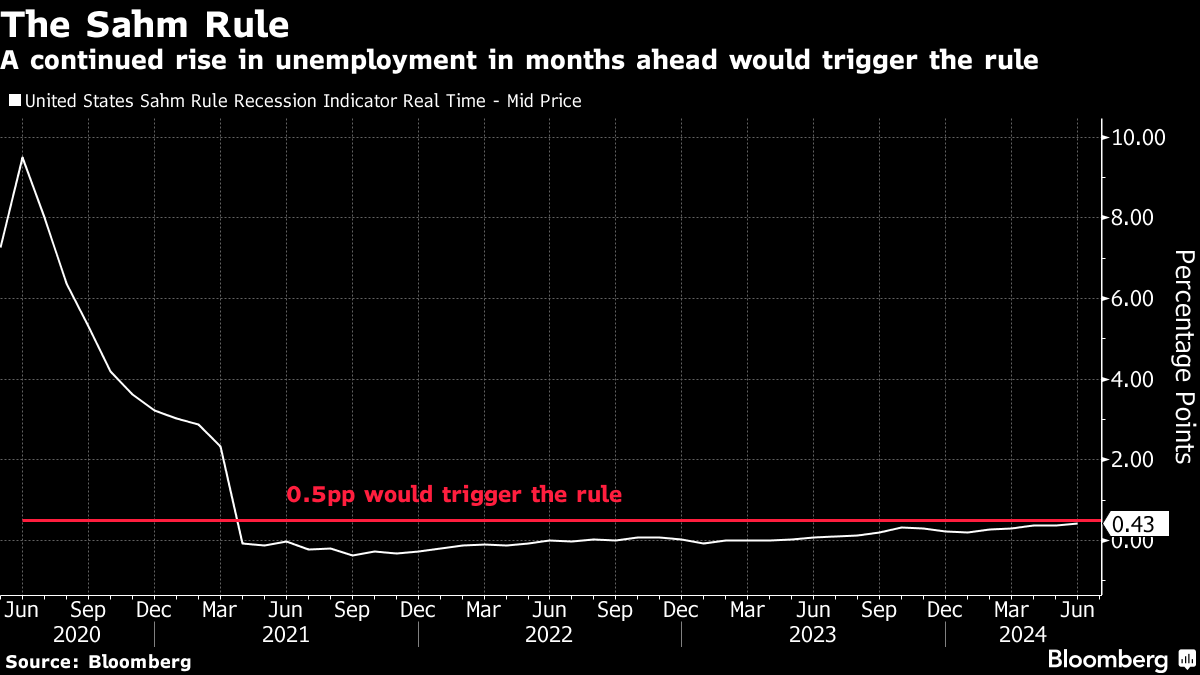

Based on Sahm’s rule, we can no longer rule out inertia. If unemployment rises to 4.2% in July, it will trigger Sahm’s Law. This is an indicator developed by American economist Claudia Sam, and states that a recession begins when the three-month moving average of unemployment rises at least 0.5% from the lowest level of the previous 12 months.

Simply put, if the unemployment rate rises rapidly in a short period of time, it indicates that the economy is entering a recession or is already in a recession.

In the short term, these developments are positive for stocks and the price of Bitcoin. After all, investors are waiting for interest rates to drop quickly.

However, the risk is that we will have a recession, which is especially dangerous for stocks. If the economy enters a recession, this will certainly threaten the earnings of companies, causing them to fail to meet expectations and causing stock prices to fall.

For Bitcoin, it remains to be seen what the exact reaction will be. It is certainly possible for the average Nvidia investor to switch to Bitcoin to protect profits.

Post Views: 1,745