Research by Bernstein, a well-known research and brokerage firm, suggests that the crypto market could grow significantly if the GOP (Republicans) wins the upcoming US presidential election. Donald Trump is the leading candidate of the Republican Party in the US elections. Analysts believe this could lead to friendlier rules for crypto, which would spur more investment in well-known cryptocurrencies like Bitcoin and Ethereum.

Analysts are bullish despite the bitcoin ETF exodus

Bernstein analysts Gautham Sukhani and Mahika Sapra note that the crypto market has recently slumped. That’s because more than $1 billion has flown out of spot bitcoin ETFs in six days. Analysts, however, remain positive. These ETFs have seen more than $14 billion in inflows since January, which they point out contributed to the 75% rise in bitcoin’s price in the first quarter.

Analysts expect major developments for Bitcoin in the near future. They hope that major private banks will soon approve spot bitcoin ETFs for their portfolios. This could increase Bitcoin allocation among new advisors and investors.

Political Change Will Help Ethereum ETFs

The potential approval of spot Ethereum ETFs by the US SEC is causing a lot of debate. Unlike Bitcoin ETFs, Ethereum ETFs do not have a staking feature, which can limit their exchange rates. But analysts believe that these ETFs will attract demand, albeit on a small scale.

Ethereum is increasingly seen as a platform for stablecoin payments and tokenization of real assets. Despite this strong use, clear rules are still lacking. Analysts predict that a change in political governance will lead to more favorable regulations, which will renew interest in Ethereum and its technologies.

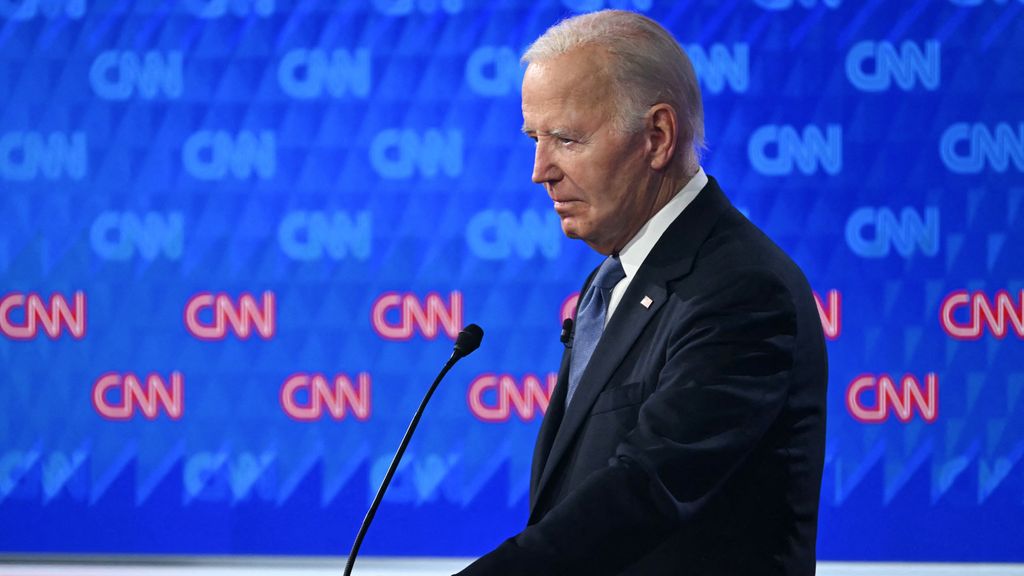

GOP victory in US election bodes well for crypto

Bernstein analysts insist GOP victory Could be a critical moment for the crypto market. They think a Republican administration could be pro-crypto, which could provide an environment conducive to the growth and integration of cryptocurrencies like Bitcoin and Ethereum into mainstream financial systems.

Despite the current market challenges, analysts believe the foundation for crypto adoption remains strong. They view the current market weakness as an opportunity for investors to capitalize on the timing. They predict that a new bull cycle could emerge in the next few years, driven by continued adoption and favorable political changes.